Written by Fullerton Markets | Jun 24, 2020 4:00:00 PM

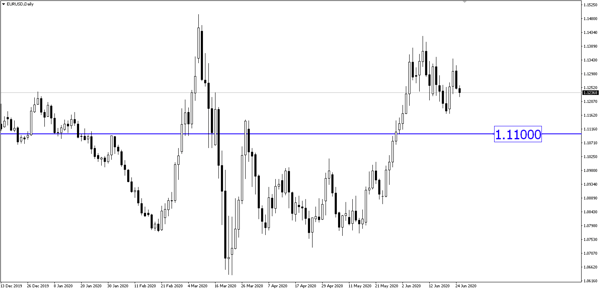

EUR/USD will find it hard to avoid a short-term dip which could take it toward the low 1.11 area.

- The near-term risk of a trade spat between the US and Europe close to the end of the quarter could be too much for the euro.

- Even if its medium-term picture is a lot brighter, especially if Angela Merkel can push through the EU recovery fund next month, there is still a clear risk of an escalation in US-Europe tensions.

- While the threatened tariffs on Europe are not game-changing, they come just as the EU is considering a ban on travellers from the US.

- The short-term positioning of trades is working against the euro as there has been a recent increase in demand for EUR selling.

- Growth signals point to pressures for higher long-end yields in both markets, but America faces stronger drivers from supply and inflation.

- With this in mind, EUR/USD could fall towards the 1.11 price level.

Fullerton Markets Research Team

Your Committed Trading Partner