"When you have confidence, you can do anything." ~ Sloane Stephens

So, how confident are you as a trader?

Numerous studies show a strong correlation between confidence and performance among athletes. The more confident they are, the better they perform. This is why confidence is considered "the single most important mental factor in sports."

Traders can be likened to athletes too. You're competing against the market and the ultimate goal is to win and earn a profit.

Therefore, if you have a high level of confidence, you'll perform better on the trading floor. If the opposite is true, you're likely to lose the game.

This is why improving your confidence as a trader is essential if you want to efficiently manage your risks and trade successfully.

Let's test your confidence level

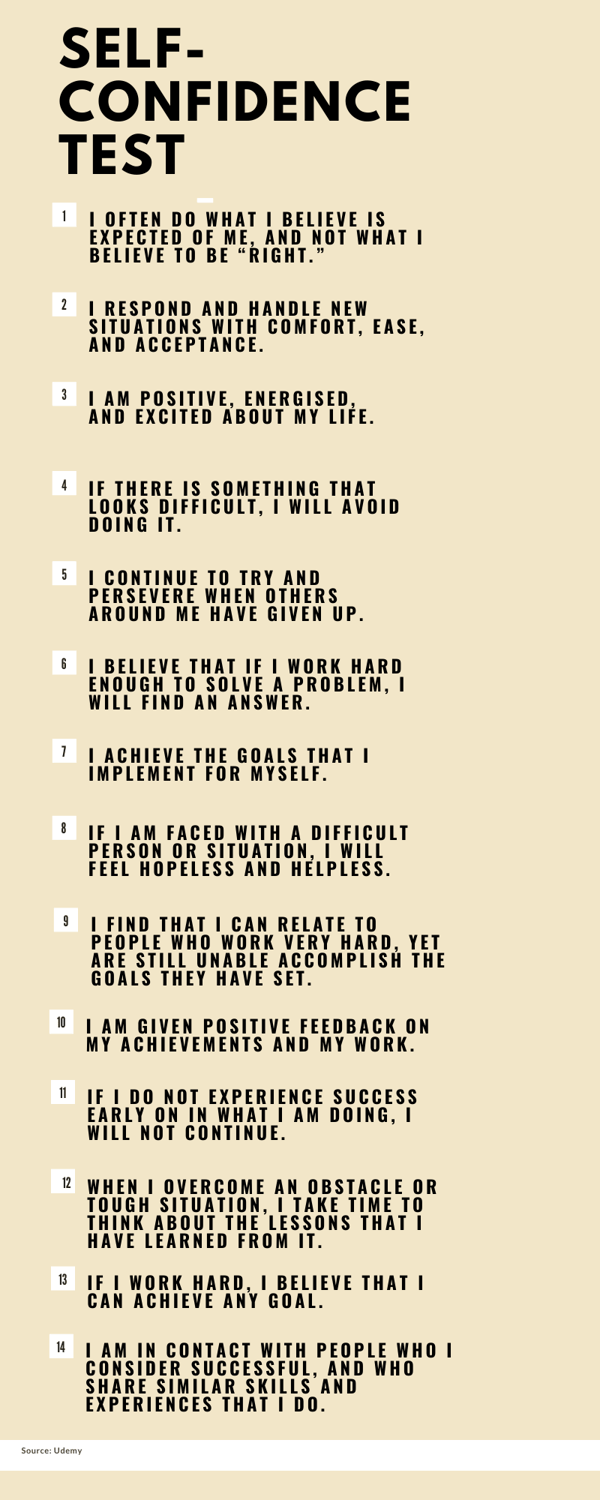

This short self-confidence test from Udemy will help gauge how confident you are overall, not just as a trader.

It's important that your answer all 14 questions based on how you feel at this point in your life, rather than what you hope to be. For every question, your choices are:

- Not at all

- Rarely

- Sometimes

- Often

- Very Often

Let’s begin.

Now, pool your answers together and count the number of times you answered Not at all, Rarely, Sometimes, Often, and Very Often.

What do your answers reveal?

Not at all/rarely

If most of your answers are either Not at all or Rarely, you tend to feel unsure of yourself. You can only wish you had more confidence. This will reflect on your trade: you often pull the trigger -- entering or exiting a trade prematurely.

Sometimes/Often/Rarely

If most of your answers veer on any of these three options, you're in the middle. You trust your abilities and strengths, but you also put too much pressure on yourself.

Often/Very Often

If you answer Often or Very Often for most questions, then your confidence level is on the higher end. You recognise your worth and use it to your advantage.

How to improve your trading confidence

If you find your confidence low or lacking, here are four things you can integrate into your habits to give yourself a boost.

1. Focus on what you can control

"When you have confidence, you can have a lot of fun. And when you have fun, you can do amazing things." ~ Joe Namath

There are two things in the Forex market that you have no control over -- price and trade outcomes. So why worry over them?

What you should focus on are the things that you CAN control.

- What to trade

- When to trade and not to trade

- When to exit a trade

- The level of risks to take

- The tools/strategy you'll use

- Your reaction towards the outcome

- Your skills and knowledge

Think about it. If you can keep a lid on your emotion when you lose a trade, you avoid overtrading or chasing your losses. If you don't open a trade because your setup isn't present, you avoid making an incorrect move.

By focusing on these aspects, you can control how much you win or lose when a trade is over.

On that note, develop the habits of a great Forex trader and learn to trade based on logic rather than feelings. Once you do, your confidence will naturally improve.

2. Practise, practise and practise some more

"Confidence comes from discipline and training." ~ Robert Kiyosaki

Given the unpredictability of the Forex market, it's important that you're prepared for every possible scenario. The only way you can achieve this is through constant practice. What's the point of acquiring all that knowledge if you don't put it into practice anyway?

This is why learning is a life-long process in Forex trading.

Moreover, practice will help you achieve mastery over the strategies and tools you use, preparing you for whatever twists and turns that will come your way. This, in turn, will boost your confidence. You’ll be able to handle any situation efficiently, despite not knowing how the market will react.

3. Focus on your process

"Skill and confidence are an unconquered army." ~ George Herbert

Most traders trade for the returns. There’s nothing wrong with this.

However, if you focus too much on the rewards, you could hurt your portfolio. You're not guaranteed 100% profit in every trade due to the high volatility of the Forex market.

So it doesn't make sense to focus solely on profit.

Consider this scenario: after two winning streaks in a day, you felt that the market is still in your favour. So you opened another trade with twice the lot size as the previous one. Unfortunately, the market reversed. What you earned that day was completely wiped out.

Because you want to earn back what you lost, you started revenge trading. We all know how that story is likely to end.

However, if you focus on your trading plan and process, you can better protect your account. You know exactly when to enter and exit a trade. You know when to stop trading or not to trade at all.

The more you stick to your trading plan, the more consistent you are with your trades.

4. Choose a trustworthy broker

"If you can learn to create a state of mind that is not affected by the market’s behaviour, the struggle will cease to exist." ~ Mark Douglas

Finding a suitable and reliable broker is key when you get into Forex trading. How else can you ensure a favourable outcome if your broker can't execute a trade at the best price or charges high commission rates? Regardless of your skills and knowledge, the wrong broker will hurt you.

So choose a broker that has an excellent reputation and is known to offer the best products and services. You'll be more confident trading with them, too.

One last thing...be confident, not arrogant

"There is a very thin line between confidence and arrogance." ~ Adam Peaty

Being confident in your ability as a trader will help you become consistently profitable. This can translate to a series of successes and wins, which tend to make anyone become overconfident.

If you find yourself becoming arrogant -- stop.

An important part of being a confident trader is your ability to handle the winning periods as effectively as you would the losing streaks. Remember to stay humble or the market will bring you to your knees.

Ready to grow your wealth from the world's largest financial market? No better place to start than right here with us! Start trading with Fullerton Markets today by opening an account:

You might be interested in: How to Profit from Forex Using the Breakout Trading Strategy