With regulatory changes shaking up Canadian housing markets and uncertainty in NAFTA, Short CADJPY?

Bank of Canada will be announcing its rate decision tonight and most economists expect BoC to keep its rate unchanged. Canada CPI readings 2 weeks ago grew by 2.2%, though lesser than the 2.4% and wage growth data grew to 3.6%, highest recorded in 6 years. Furthermore, unemployment rate continue to remain at a decade low of 5.8%. These factors should have prompted BoC to raise rates comfortably.

However, there are a few reasons why BoC will choose to hold rates:

- There are a lot of uncertainty as regards to NAFTA as well as US trade policy. NAFTA negotiations was delayed, and a new deadline was set by the end of May as member countries continues to find a common ground.

- Even though oil prices rallied last week, which benefited Canadian oil exporters, the lack of investment in oil by the Canada government as well as whether oil prices is overdone could lead to BoC being cautious in raising rates.

- Canadian household are also overloaded with debt despite having a strong labour market. The increase in interest rates could put consumption under intense pressure.

- Disappointing inflation data and softer retail sales data could lead to BoC sticking to its cautious tone and it tried to guide the market towards a July hike.

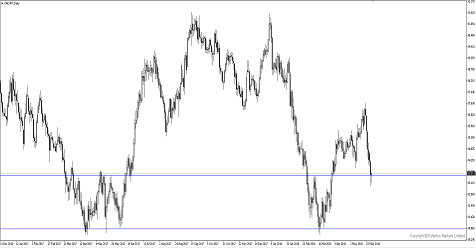

- CADJPY is reaching a crucial support at 83.4 and once broken, we could see further downside to 80.5 price level.

First-quarter GDP for the Canadian economy will be released on Thursday, a day after BoC rate decision. Market is expecting GDP to grow at a 2% rate versus expected of 1.3%. If results are as expected, this increases the possibility of a rate hike in July.

Fullerton Markets Research Team

Your Committed Trading Partner