Less properties being bought in China may harm Australia’s economy, short AUD/USD?

China’s Citic Bank has halted new consumer loans in Beijing for individuals pledging their property as collateral, Bloomberg reported by quoting the people familiar with the matter.

- Citic Bank decided to halt the consumer loans for its own internal business reasons, rather than under prompting from Chinese regulators, according to the people.

- This is important asit may suggest Citic’s own perspective on the domestic housing market towards a less positive outlook.

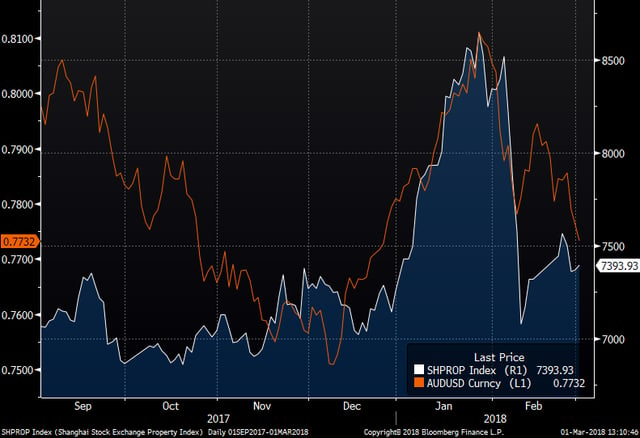

- The chart below shows AUD/USD moving in tandemwith Shanghai stocks property index most of the time for the past six months; both started rallies since mid of December last year and peaked at the end of January this year.

AUD/USD (Orange line); Shanghai stocks property index (white line)

- Any prediction on less activitiesin Chinese housing market, if proved to be accurate, may add downward pressures on Aussie.

Fullerton Markets Research Team

Your Committed Trading Partner