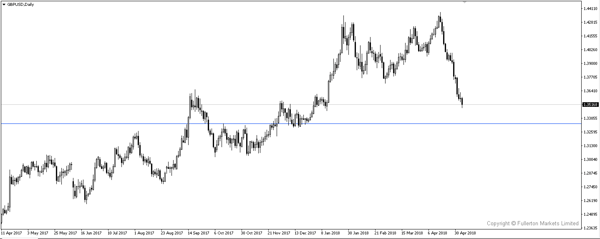

Despite a fall in wage growth and jobs created, the unemployment rate fell to December 2000 low of 3.9%. short GBPUSD?

Earlier indicators show that a below-estimate US jobs report is possible, which could weigh on the dollar. However, unemployment rate surprised the market with a staggering 3.9%, the lowest since December 2000.

- 164k jobs were created versus the forecasted of 190k.

- Both ISM manufacturing and service PMI dropped substantially last month, suggesting business environment turned tougher in the month of April

- Despite US Initial Jobless Claims 4 Week Moving Average was largely unchanged, unemployment rate surprised the market. There have been four periods since 1950 when the unemployment rate flirted with sub-4% readings: 1951-53, 1956-57, 1966-70 and 2000.

- Even though wage growth, which was supposed to be the main focus, fell from 0.2% to 0.1% the market took a cue from the unemployment rate.

- The fall in wage growth indicates that recent pick-up in inflation could be just driven by higher oil prices.

- The buying pressure of GBP/USD was short-lived given that softer data was met with better than expected unemployment rate, causing it to fall through the 1.3500 handle.

Fullerton Markets Research Team

Your Committed Trading Partner