With no rate hike expected from the ECB in the first half of 2019, short EUR/JPY?

- Draghi’s tone was dovish as he said balance of risks are moving to the downside.

- Historic net asset purchases program has ended as expected, but the ECB promised to keep reinvesting past the first interest rate increase. In the next few months, investors will shift their attention to the ECB’ answers on the specific period.

- Incoming data has been weaker than expected and this may suggest lower growth momentum ahead. Thus, we don’t expect the ECB to boost policy rate in the first eight months of next year.

- Eurodollar move is very important for Asian assets, as it directly impacts the dollar given its 57.6% weighing in dollar index. Any fall in the euro would boost the dollar, and that reduces the policy easing room for some Asian central banks, such as China’s PBOC.

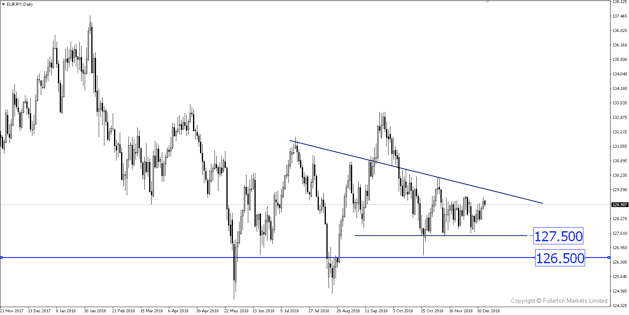

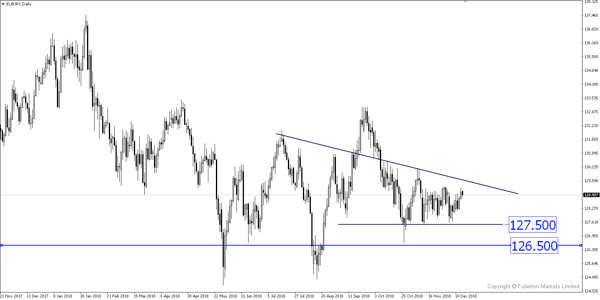

- EUR/JPY has been ranging for the past few months with no clear direction. As Draghi mentioned the general uncertainty the market is facing currently, we believe that safe haven assets could continue to strengthen until March 2019. This gives EUR/JPY more room to fall in time to come. EUR/JPY could fall to 127.50 and eventually the price level of 126.50.

Fullerton Markets Research Team

Your Committed Trading Partner