Fed’s dot plot included a rate cut for the first time and lowered economic projections. Short USD/JPY?

There is no doubt Fed is leaning towards dovishness after it removed “patient” from its policy statements and mentioned that future rate cuts will be coming and the speed of when it will come is dependent on data.

There are five things which we believe could be the deal breaker for dollar to move lower:

- Fed removed “patient” from its monetary policy which was previously seen as hawkish.

- The dot plot is signalling an interest rate cut with 8 out of 17 members seeing a cut in 2019.

- Fed lowered economic projections for inflation.

- US-China trade negotiations, which are hurting the US economy based on consumer outlook, are wavering.

- Jobs growth is showing signs of moderating which was one of the main reasons why Fed is keeping rates unchanged this month.

However, dollar did not dive sharply as what markets were expecting. This is due to Powell who kept a brave front and described the labour market as strong and said incoming data is good especially on the consumer level. We feel that it’s only a matter of time before the incoming US data shows signs of a slowdown to justify a rate cut.

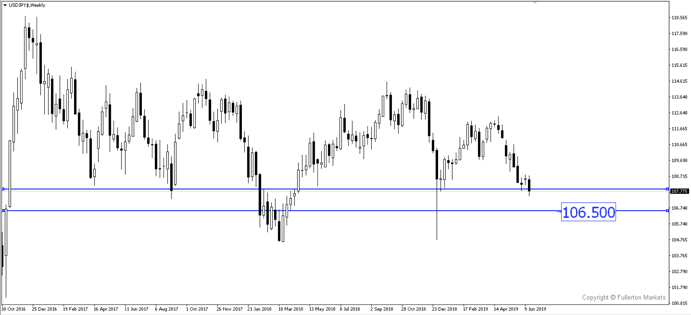

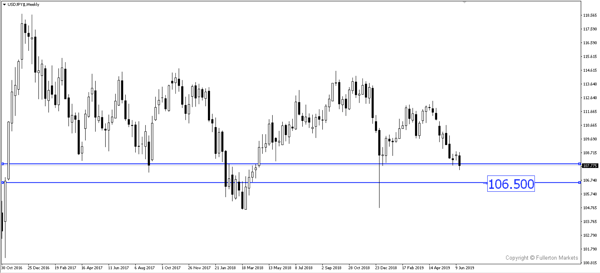

USD/JPY broke the 107.90 historical support after Fed’s announcement. We believe that the next target will be 106.50.

Fullerton Markets Research Team

Your Committed Trading Partner