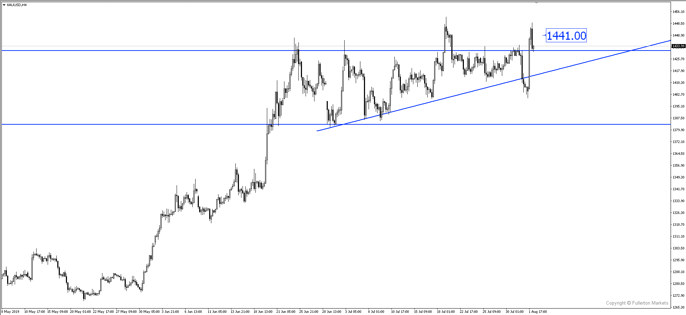

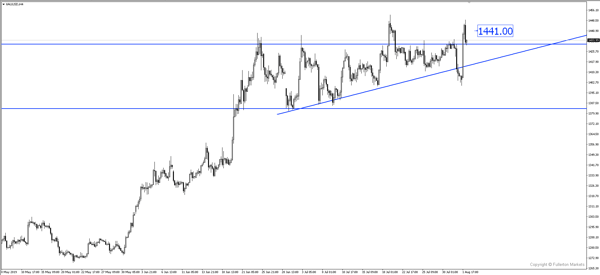

China is likely to retaliate if the tariffs were to go into effect, which could cause funds to flow into safe havens. Gold could resume its uptrend.

President Trump escalated the US-China trade war last night through a tweet saying that “US will start, on September 1st, putting small additional tariff of 10% on the remaining $300 billion dollars of goods and products coming from China”. This will come on top of the 25% duty already in place on some $250 billion worth of Chinese goods.

This came as a surprise which also brings an end to the truce that was in place when Trump met Xi in Osaka in June. China’s Foreign Minister Wang Yi responded by saying that “Imposing new tariffs is absolutely not the right solution to trade frictions.”

During FOMC early in the week, Powell cited the risk of rising trade tensions as a major reason as to why Fed cut its rates by 25bps. The escalation of the trade war could force Fed to look for further cuts as early as this year.

However, Trump has a tendency to walk back on his words when it comes to political affairs. Only until the eleventh hour will we know if Trump is going to stay true to his words.

Gold could resume its uptrend back to the 1441 price level.

Fullerton Markets Research Team

Your Committed Trading Partner