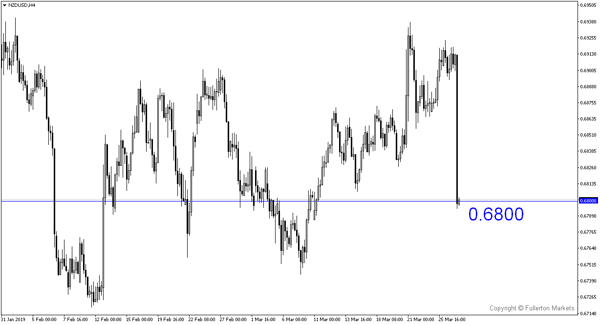

NZD/USD plunges over 100 pips, long NZD/USD at dips

New Zealand's RBNZ joined the global shift away from tightening, saying its next move is more likely to be a cut, sending the kiwi dollar tumbling over 100 pips.

In our opinion, we struggle to see clear evidence of a sharp slowdown that justifies the policy shift, even after combing through recent data. Instead, it smacks on a central bank belatedly bowing to global peer pressure.

Here are four reasons why we think the sell-off may not last:

- New Zealand's annual growth rate slowed slightly in 4Q but compared to the previous quarter, growth actually picked up.

- Retail sales have been the strongest in almost two years.

- Latest manufacturing PMI edges higher and remains comfortably in expansion territory.

- Tuesday's trade balance is a positive surprise, thanks to stronger exports.

New Zealand is a small open economy and the RBNZ must be sensitive to broader external influences, as reflected in today's statement.

NZD/USD likely to find some support around 0.6800 in near term, consider to Long at dips.

Fullerton Markets Research Team

Your Committed Trading Partner