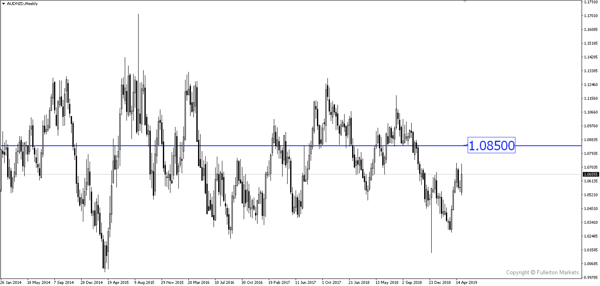

With the monetary policies between RBA and RBNZ diverging, AUD/NZD could rise.

The RBNZ believed that a lower Official Cash Rate (OCR) is necessary to support its outlook for employment and inflation consistency with its policy remit, according to its statement earlier.

- The central bank is worried about the outlook for employment growth being more subdued. Furthermore, capacity pressure is expected to ease slightly in 2019. Consequently, inflationary pressure is projected to increase at a slower rate.

- Given the recent weaker domestic spending, projected ongoing growth and employment headwinds, there was a need for further monetary stimulus to meet RBNZ’s objectives.

- Kiwi may tumble against the Australian currency after the RBA refrained from cutting rates on Tuesday.

- New Zealand government bond yields are extending declines, with the two-year yield now down eight basis points.

- RBNZ now sees average OCR could fall to 1.36% in Q3 2020.

Fullerton Markets Research Team

Your Committed Trading Partner