As the first few countries to ease the coronavirus restrictions, New Zealand’s economy will recover faster as well. Long NZD/USD?

- The Reserve Bank of New Zealand (RBNZ) left official cash rate on hold at 0.25% as widely expected, but open doors to further interest rate cut, including taking them negative if needed.

- The RBNZ also increased its bond-purchase program to NZ$60 billion from NZ$33 billion.

- Furthermore, RBNZ is also prepared to add Large Scale Asset Purchase (LSAP) program and provide fixed-term loans to banks.

- New Zealand dollar dived sharply after the announcement. This could be a knee-jerk reaction given that nearly all the central banks around the world are expanding its stimulus to support the economy.

- The economy contracted 2.4% in Q1 and is expected to weaken to 21.8% in Q2.

- Given that the New Zealand economy is quick to contain the pandemic and is looking to reopen soon, the New Zealand dollar could strengthen against the rest of the currencies.

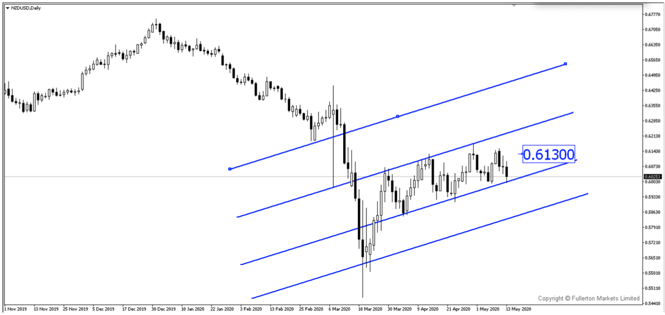

- NZD/USD could head higher towards 0.6130.

Fullerton Markets Research Team

Your Committed Trading Partner