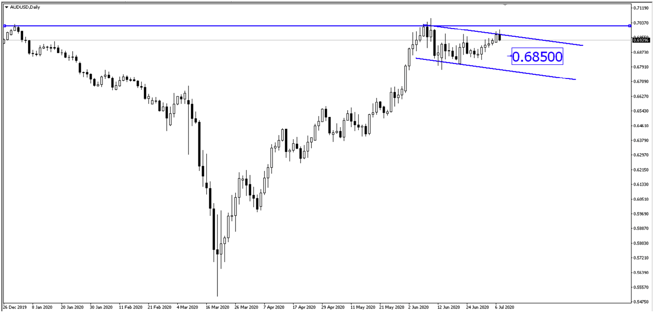

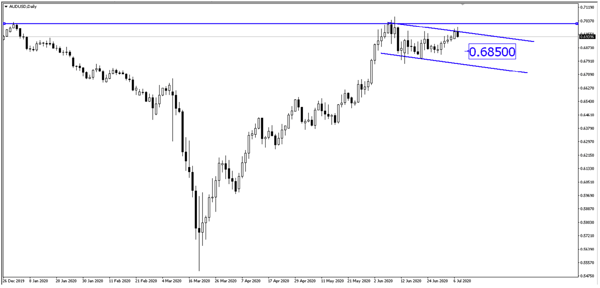

With RBA keeping rates unchanged for years to come while keeping stimulus on the table if required, Aussie dollar could remain weak for now. Short AUD/USD?

- The Reserve Bank of Australia (RBA) kept rates unchanged as widely expected, with the bank previously signalling that interest rates will remain extremely low for years to come.

- RBA Governor Lowe said the nature and speed of the economic recovery was “highly uncertain.”

- He also said, “The uncertainty about the health situation and future strength of the economy is making many households and businesses cautious, and this is affecting consumption and investment plans.”

- Even though Australian consumer spending rose, most of the spending are on household goods and groceries, instead of services such as travel and entertainment.

- One main concern that could cripple Australia’s current recovery momentum is the fiscal cliff in September. Most of the stimulus will be expiring in September and the economy could take a hit.

- The biggest risk will be the AU$75 billion home loan default cliff when JobKeeper payments and banks’ 6 months mortgage holiday end.

- With a weak employment rate in Australia, many mortgage holders fear that they might have to sell their home. This could cause an economic domino effect.

- Lastly, we are also seeing a resurgence of COVID-19 cases in Victoria as the news reported its largest increase with 190 cases in one day.

- All in all, we believe that the RBA will remain open for further stimulus if required.

- AUD/USD could fall lower towards 0.68500 price level.

Fullerton Markets Research Team

Your Committed Trading Partner