With exports accounting for 30% of New Zealand’s GDP, RBNZ will keep NZD weak in order to spur exports amid the global pandemic. Short NZD/USD?

- The Reserve Bank of New Zealand (RBNZ) kept interest rates unchanged at historic low of 0.25% today as widely expected but it is open to further stimulus, if required, to counter impact of the pandemic.

- Furthermore, RBNZ will be keeping its Large Scale Asset Purchase program at NZ$60 billion (USD39 billion) with room for further expansion, if needed.

- In its statement, RBNZ said they will be keeping official cash rate at 0.25% at least until March next year.

- RBNZ remained dovish despite New Zealand’s success in containing the pandemic which allowed it to be the first few countries to reopen its economy.

- This could mean that the economic impact of the pandemic might not be as bad as RBNZ forecasted in May. Still, RBNZ wants to keep its further stimulus on the table.

- The recent strengthening of NZD is a concern for New Zealand given that exports consist of 30% of its GDP. And with tourism at a complete standstill, keeping NZD weak to spur exports will accelerate the recovery of its economy.

- With this in mind, we expect the RBNZ to remain dovish until at least most of the global economies recover.

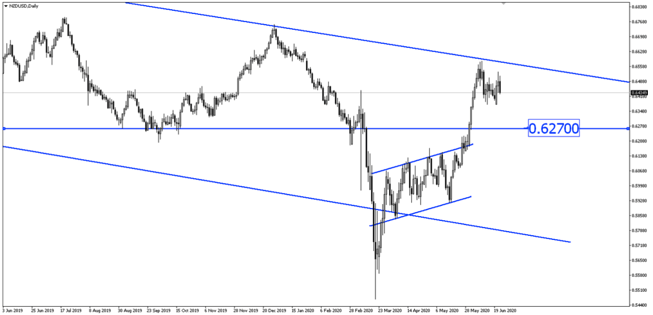

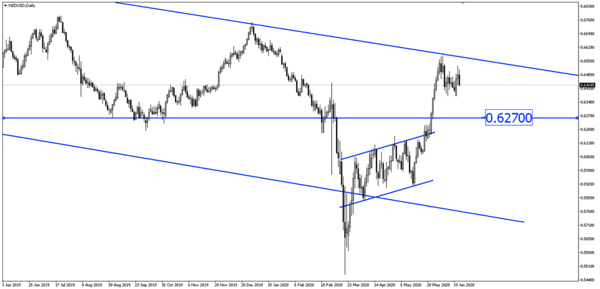

- NZD/USD could fall lower towards 0.6270 this week.

Fullerton Markets Research Team

Your Committed Trading Partner