The US governors are reversing plans to reopen their states as the country registered the biggest jump in coronavirus cases. However, markets remain bullish in trust that Fed will continue to provide stimulus. Long S&P 500 at dips?

- The VIX index, also known as Wall Street’s war gauge, is quite stable so far, even as various negative news and headlines are suggesting a huge sell-off in risk assets.

- This means that investors are not panic at this moment and they are looking to buy at dips again.

- Furthermore, Wall Street firmly believes that the worst-case scenario equates to more stimulus from the Federal Reserve.

- There are going to be a few more dips on the way but the market doesn’t care about fundamentals or earnings at this point, they care about the stimulus during the pandemic and after the pandemic.

- US Banks surged in the US session after regulators eased rules that will free up capital, though they slid after-hours as the Fed told the biggest lenders they can’t increase dividends or buybacks for now.

- Having said that, every dip in US stock futures is a buy as long as Fed continues its unlimited QE.

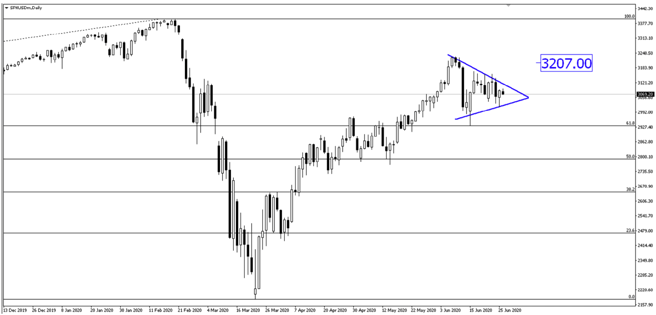

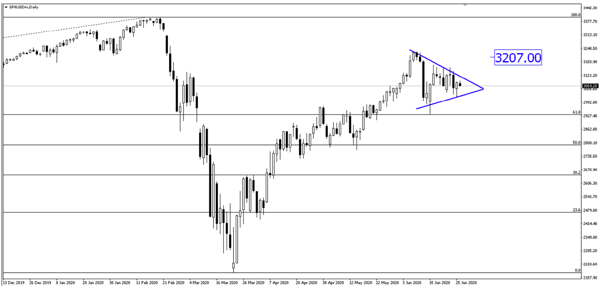

- The S&P 500 is forming a symmetrical triangle chart pattern and could breakout higher towards 3207 price level.

Fullerton Markets Research Team

Your Committed Trading Partner