Even though the Non-Farm Payrolls (NFP) released tonight might be painting a good picture for the US economy, the labour market still has a long way to recover the 20 million job losses in April. We believe that USD/CHF can fall lower.

- The US NFP came in stronger with 4.8 million jobs gained for the month of June versus the forecast of 3.037 million. Dollar initially edge lower before climbing higher due to optimism.

- Unemployment rate fell from 13.3% to 11.1% but we advise to take the data with a pinch of salt, considering the fact that the Bureau of Labour Statistics (BLS) reported that they had difficulty estimating and classifying certain furloughed employees.

- Lastly, average hourly earnings fell to -1.2% versus forecast of -0.8%. One reason why the average hourly earnings fell could be due to lower-paid workers returning to the workforce, bringing down the average.

- Even though the NFP data shows that the economy is picking up, we remain sceptical on its full recovery, given that there is still a long way to go to recover the 20 million job losses in April.

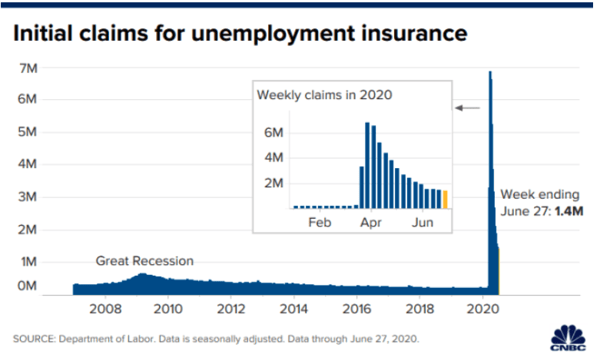

- Furthermore, US weekly jobless claims last week rose to 1.427 million vs the 1.38 million forecast.

- This is the 15th straight week that the jobless claims are above 1 million.

- Especially with the 2nd wave of infections still on the rise and many parts of US rolling back their reopening plans, we believe that the optimism from NFP will be short-lived and traders should position themselves for more risk-off flows in the coming months.

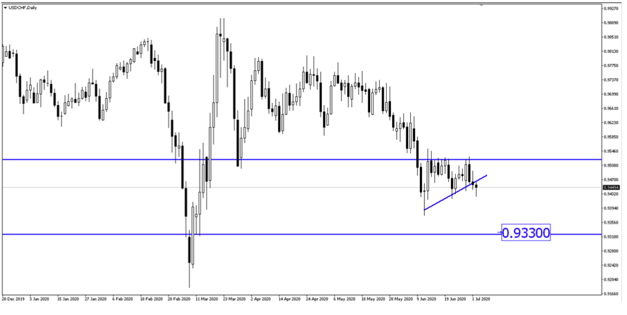

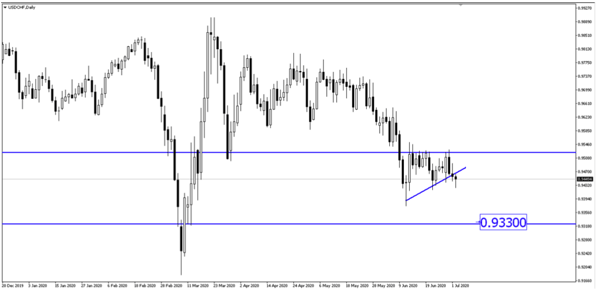

- USD/CHF has broken the support level and we believe that the temporary strengthening of dollar could provide a better short opportunity. USD/CHF could fall towards the 0.93300 price level.

Fullerton Markets Research Team

Your Committed Trading Partner