As yen’s movement is decided by risk sentiment instead of BoJ, short USD/JPY?

The minor tweak to the Bank of Japan’s forward guidance does not change the big picture that monetary policy is likely to remain extremely easy for the foreseeable future.

- Stocks sentiment has been extremely bearish in Asia recently as China stocks continue to fall for the second day.

- Risk-off momentum will continue to pressure USD/JPY.

- BoJ said it will keep rates extremely low for an extended period, with a new reference to “at least through around spring 2020.”

- The muted reaction in the yen suggests the market wasn’t fired up by the news.

- Governor Kuroda said the change strengthened its forward guidance and thought the extended period implied a considerably long time. However, the market believed it to be shorter.

- Lastly, the BoJ said it will consider introducing a facility to lend ETFs it has accumulated to investors. This suggests some concern about low liquidity and price distortions caused by its purchases.

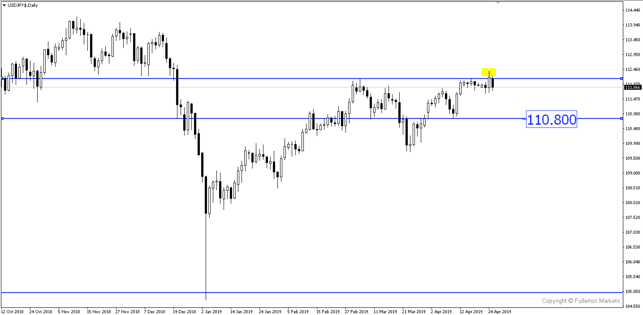

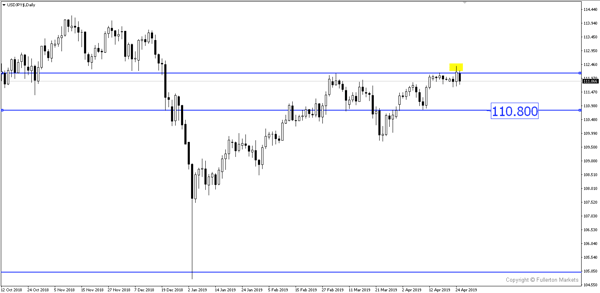

- USD/JPY recently formed a false breakout, wiping short-sellers whose stop loss is around the 111.40 price region. We believe that this pair could fall further after as the false breakout confirms a bearish bias.

Fullerton Markets Research Team

Your Committed Trading Partner