ECB’s policy tweak narrows the US/German bond yield spread, long EUR/USD?

Euro dollar surged one of the highest in one month overnight as ECB surprised the market by saying they are open to tweaking their policy guidance soon so as to align it with a strengthening economy.

- EUR/USD gained 0.7% overnight, one of the highestsince Dec. 13 last year after the ECB’s news

- Some interbank traders said buy stops above 1.2059 overnight high were targeted

- We thinkthat the tweak in the forward guidance will happen over the coming months as long as the WTI crude oil price to stand over $55. Price above this level would push euro zone’s CPI towards 2% based on our multi-regression analysis model

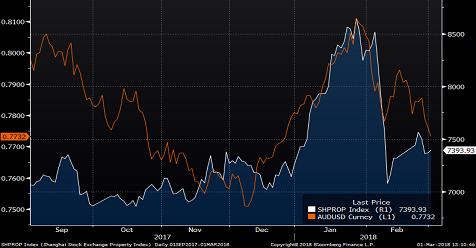

- Minor tweak in the Bank of Japan’s bond-purchase operation on Tuesday saw the yen strengthen more than 1%in two days. Alongside with the market reaction from ECB, we should expect the dollar to be driven mainly by international central banks, and less on what Fed does this year.

- The spread between US 10 year yield and German’s shrinks to 196bps from 201bps two days agowhich was negative to dollar. The spread between the two would be the key factor to move the EUR/USD in first half of 2018

Fullerton Markets Research Team

Your Committed Trading Partner