There are lots of strength in China’s GDP data even as it slows to decades low, buy AUD/USD

Chinese economy may have approached the bottom in June

While China’s GDP growth slowed to 6.2% in the second quarter from a year before, the weakest since the early 1990s, key monthly indicators showed an acceleration in June.

The Statistics Bureau spokesman Mao Shengyong said that there has been positive feedback from the government’s tax cuts, and that the effects of policy measures will strengthen in the second half of the year. The data reduced the case for the PBOC to follow the projected interest-rate cut by the Federal Reserve on July 31.

Automobile, online sales and spending on cosmetics helped boost retail sales, which rose 9.8% in June from a year before, beating all forecasts. The pick-up in consumption could be due to Chinese spending more at home and less on overseas trips. The gain in car sales also corroborates data from the industry for June that showed the first gain in 13 months.

Industrial production also beat all forecasts for June, with private investment rising the most since March. While public investment growth slowed, the overall rise of 5.8% for fixed-asset investment suggested that the central bank’s targeted monetary easing is having some impact. The investment gain also came in a month when credit growth accelerated.

Property investment was solid, rising 10.9% in the first half compared to the same period of 2018, up from 9.7% in the first half of 2018. Home prices rose at a slower pace in June than the previous month, indicating that curbs imposed by authorities concerned about escalating costs are having an effect. Overall market reaction was muted, with Japanese markets closed. The yuan was little changed, as was the Aussie – often a proxy for bets on China growth. The Shanghai Composite Index did climb after the data, however, taking back all of its 1.5% loss from earlier in the session.

Even if China's economy could be graded a 'pass' for the first half of the year, a lot of work still needs to be done. Some of the risks China still faces: the US could impose higher or new tariffs at any point and slowing global growth means weaker demand for Chinese goods. Domestically, the challenge will be on how to support the economy without going on another debt binge.

June’s data reduces the case for the PBOC to cut interest rates following the anticipated Federal Reserve move on July 31. In the past, the PBOC has occasionally followed Fed rate moves, by changing its targets for money-market rates. With this pick-up in the monthly data, there is less immediate need to lower those rates.

Our Picks

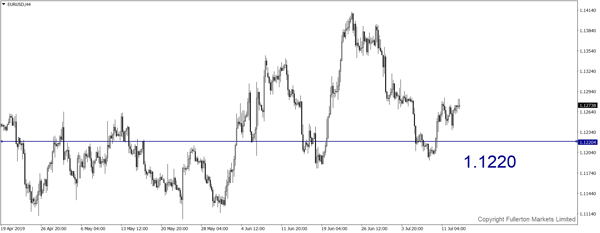

EUR/USD – Slightly bearish.

This pair will drop towards 1.1220 this week.

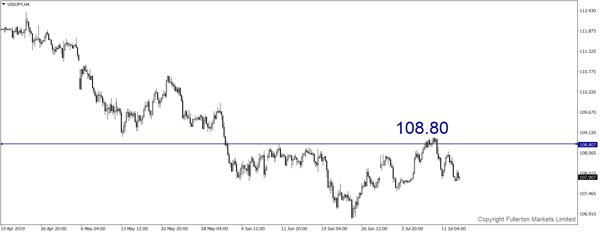

USD/JPY – Slightly bullish.

This pair may rise towards 108.80 as risk sentiment could improve.

XAU/USD (Gold) – Slightly bearish.

We expect price to drop towards 1390 this week.

U30USD (Dow) – Slightly bullish.

Index may rise towards 27500 this week.

Fullerton Markets Research Team

Your Committed Trading Partner