Price Average Strategy is a capital management method used by many strategy providers on our CopyPip platform. In today's article, we will learn how to recognise SPs who are using this strategy, its advantages and disadvantages, and what to look out for when following them.

What is the Price Average Strategy?

Price Average, also known as the Dollar Cost Average (DCA), is a widely used method in investing stock and it is a method of dividing capital to invest in a fixed period for a long time.

How to apply this in Forex trading?

Using this method, strategy providers will trade with multiple small lot sizes. For example, when a trader is going against the trend of the market on the first order, the second order will be executed if the market continue to go against. If the market continues to move in the opposite direction, only then will the consecutive orders be activated. Trading volume and order entry distance will depend on the SP.

Each new order will always have a price that is the average price of all orders, where the sum of all orders’ profit will be equal to 0. This will usually be the middle point of the orders. In case the market goes against the direction, the market just needs to retrace slightly for the orders to return to the breakeven point. SPs that trade with this method usually do not use SL for their orders and will use the average price point to exit orders.

Advantage

When you follow SPs using this trading method, your profit can scale or allows you to have break even trades.

Disadvantage

On the other hand, there is a risk that when the market trend goes against the trading direction of the SP, all the orders will be losses. Furthermore, if the market continues to move in the negative direction of the orders, then the losses will scale as well.

How to identify SPs who are using Price Average Strategy?

There are four characteristics of a SP who uses Price Average Strategy.

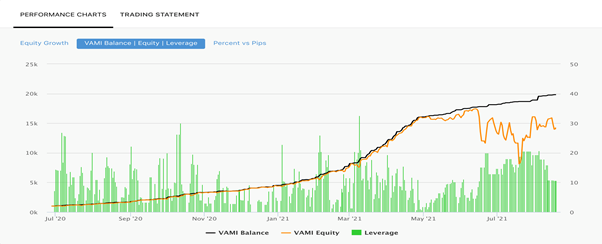

- In the Performance Charts, you will easily see that these SPs often make regular profits, so the Equity line (orange) and the Balance line (black) are often very close to each other. However, there will be times when both these lines are very far apart because the market trend and the SP's trading direction are differing and may worsen.

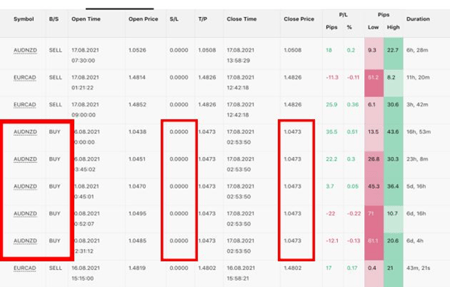

- In the Trading Statement, you will be able to see clusters of trading orders with the same trading direction.

- These orders usually do not use Stop Loss so you can see that the S/L column is showing 0.0000.

- These orders will usually have the same take profit price.

What to take note of when following SPs who are using this method?

- Use a larger capital than the recommended capital to increase the buffer in terms of capital percentage.

- Always set the protection level in the advanced settings so that you can protect your remaining capital in the worst case scenario.

- When there is a trading profit, prioritise withdrawing the profit to preserve the capital instead of keeping it to reinvest. You can reinvest in other SPs to reduce your investment risk.

In summary, the Price Average Strategy is a capital management method used by many strategy providers. We believe that the above information will help you to be more confident when choosing which SP to follow.

Fullerton Markets Research Team

Your Committed Trading Partner