We are going to look at the performance of strategy provider (SP), “Eternity”, which we analysed back in December 2020.

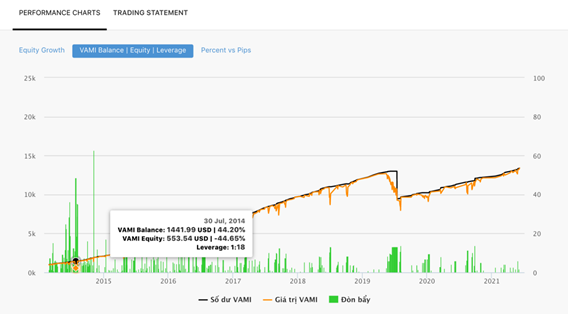

“Eternity” has been trading for more than 5.5 years now. Their trading history started all the way back in 2014 and their YTD performances have been positive every year, except in 2019.

From our previous review in December 2020 until the end of last month, they grew by 8.82% with an average return of 2.9% per month.

Furthermore, their maximum drawdown remains at 64% and we would consider them a high-risk strategy provider. However, if we look at their performance chart, we can see their lowest point was on July 30, 2014, with only 1441 USD in their account. Based on their stable trading results since then, it seems that they have become more disciplined. Therefore, we will consider them a medium risk SP.

They are averaging at 26 pips profit and if we were to subtract 0.7 pips commission by the Copypip platform, it does not affect their profit and loss much.

Lastly, following their track records, we feel that we can trust this SP and will be suitable for those who are looking for security and stability. You should also add an additional safety net by adding a stop loss through advanced settings to protect your capital.

Fullerton Markets Research Team

Your Committed Trading Partner