We are coming back to “NEW 2000”, one of the top strategy providers that we reviewed last year, December 2020.

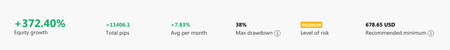

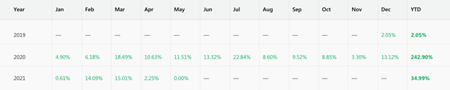

We previously chose this strategy provider as our top pick of the week as they had a steady average of 8.59% per month, with a growth of 246% and a maximum drawdown at 38%. Currently, although their average monthly return is down to 7.83%, their growth has increased to 372%, with the same maximum drawdown.

Their results remain spotless with no negative months and we believe that this will continue.

We regard them as a low-risk provider, given the low maximum drawdown and their returns. With their track records, “NEW 2000” continues to be reliable for investors who are not looking for sky high returns but a strategy provider that continue to protect their downside while producing stable returns.

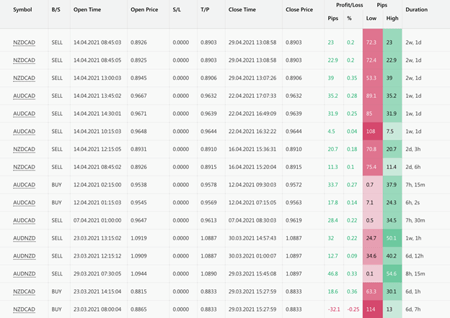

Their average net profit in pips is 8.75 pips, which is great, as the current CopyPip still charges a 0.7 pips commission. You can see that their orders do not have a stop loss set. You can protect your account by setting your account protection to 40%, in case they put risk emerged as unprecedented.

What is the verdict then? Will I continue to recommend this provider? If you are a risk-averse investor, looking to step into the copytrading industry, then of course go ahead and follow them.

However, they would not be the right fit for you, if you are looking for huge returns and would rather go with someone with bigger returns. Ultimately, it depends on your risk appetite. For advanced users, you can minimize your risk with safety nets placed in the advanced settings. You can find out how to do this from our previous “Copy Tip of The Week” videos.

Fullerton Markets Research Team

Your Committed Trading Partner