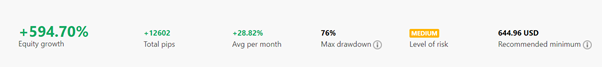

Today we will be discussing a strategy provider called “Skat”. The first thing that caught my eye is the maximum drawdown at 76%. With this, “Skat” is considered a high-risk SP.

This SP has an equity growth of 594.70% and an average monthly profit of 28.82%. These statistics show that even though they are a high-risk SP, they are rewarded by huge returns.

From their track records below, they are impressive, despite several months of losses. In March, when they lost the most at 72.33%, they gained 279.16% the next month.

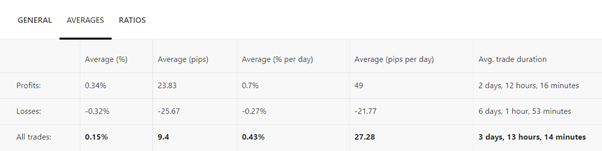

As we look at their trading statements, we realised that they do not put a stop loss, which is risky. If you follow this SP, you can use the advanced settings to set a fixed stop loss, in case this strategy provider allows their trades to float to huge losses and is unwilling to close them.

We are aware that the duration of each trade could take days, so you must consider having a higher capital buffer to cover potential losing position.

They have an average of 9.4 pips, which is sufficient to cover the 0.7 pip commission charged by CopyPip.

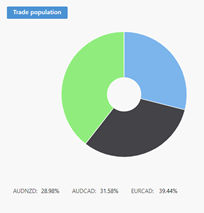

Lastly, they focus on AUD/NZD, AUD/CAD and EUR/CAD. You should consider this SP if you want to focus on a few key currency pairs.

Fullerton Markets Research Team

Your Committed Trading Partner