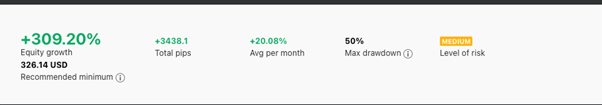

Today, we are looking at a strategy provider called “ThinkTwiceSniper1”. The first thing that caught my eye is their maximum drawdown at 50%. It is on the high side for most traders but you will understand that this is considered medium risk if you trade Forex.

An equity growth of 309.20% and an average monthly profit of 20.08% are statistics that are in line with a medium risk strategy provider.

In their description, you will notice that they are from Singapore, with clear details on the exact way you should follow them. They mentioned that the recommended capital to follow them is USD300, which is good news for most traders, as it is a low requirement.

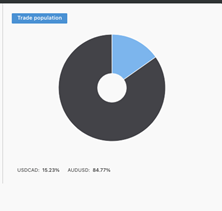

Furthermore, this is only one part of their trading strategy for AUD/USD. If you are looking to trade EUR/USD, you can follow the other part of their trading strategy called “ThinkTwiceSniper2”. This is interesting and new as most traders would combine all their trades into 1 account. In my opinion, this is a good way to separate different strategies for different currency pairs, allowing the provider to improve on their strategies with a cleaner track record.

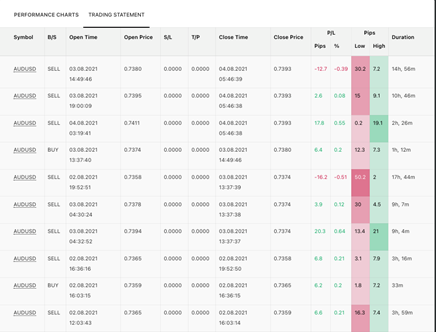

From their track records below, they have had zero losses since their inception in February.

As we look at their trading statement, we realised that they took a risk by not putting a stop loss. However, we can use the advanced settings to place a stop loss, if they allow their trades to float to huge losses and are not willing to close the trades.

Lastly, the trade population is in line with their descriptions, focusing only on AUD/USD. We do see a small proportion of USD/CAD trades, which I believe is traded unintentionally. This can be overlooked if you intend to follow this strategy provider.

Fullerton Markets Research Team

Your Committed Trading Partner