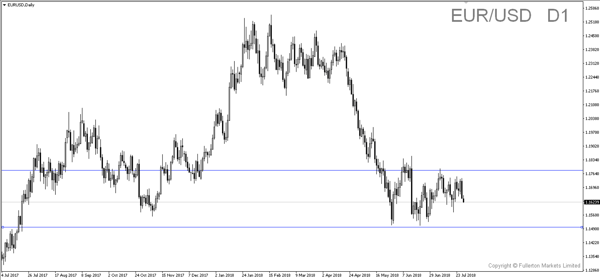

With no rate hike insight from ECB, Short EUR/USD?

Last night during the ECB’s policy meeting, President Draghi left rates unchanged as widely expected. The press conference is the highlight of the event as investors are curious to know if President Draghi’s forward guidance is still the same as before.

The Governing Council reiterated that they expect interest rates to remain at present levels at least through late 2019. They repeated that additional support will come from its policy of reinvesting maturing debt.

These are the 3 reasons why we feel that President Draghi’s stance was dovish last night:

- ECB President Draghi said there is no change to the central bank’s message of keeping its rates at a record low. This meant that in near term investors will not be expecting any rate hike until the economy recovers.

- He felt that the economy is still weak with exports losing a slight momentum. Even though inflation rebounded, and employment is at a record high, he felt that EU is not ready for a rate hike just yet.

- The threat of protectionism – mainly from the trade war between US and China is a downside risks that ECB will be monitoring closely.

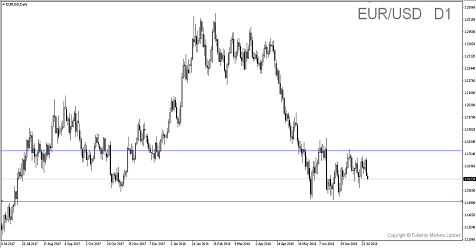

We could see EUR/USD hitting the 1.1500 price regions as there is a lack of reason for investors to back euro as of now.

Fullerton Markets Research Team

Your Committed Trading Partner