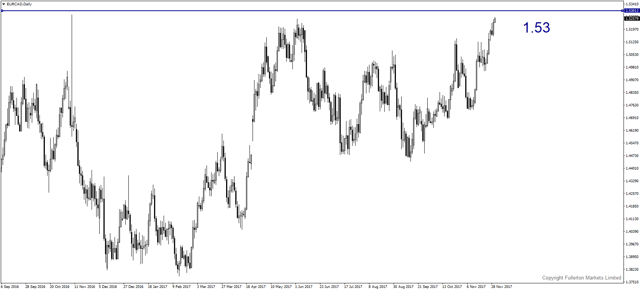

If euro zone CPI accelerates this month, long EUR/CAD?

Canadian dollar is under pressure in short-term amid slump in crude oil prices overnight. Indecision about supply cuts among the world’s biggest oil exporters pushed crude prices down in the past three days.

- OPEC and its allies are edging towards extending their production cuts beyond the current scheduled expiration in March. Market expects the cut to extend until the end of 2018, but the outcome of the OPEC meeting is uncertain now.

- WTI oil future prices slid 1.19% overnight, dropped 1.42%, and 0.21% on Monday and Tuesday respectively.

- Market expects OPEC to extend cuts to the next nine months. If the cuts aren’t extended or less than this time-period, it could lead to a decline in oil prices.

- In euro zone, it will release the flash CPI estimates later this evening at 6pm (GMT+8). The previous reading was at 1.4%. We expect the inflation to accelerate given the rising global output prices this month. Earlier this morning, China November manufacturing PMI output data rose to 54.3 from previous 53.4.

- Prospect on improving euro zone inflation and uncertainties in oil outlook could drive EUR/CAD in near term. Price may rise towards 1.53 in coming days.

Fullerton Markets Research Team

Your Committed Trading Partner