If China and US can’t reach a deal within 2-3 weeks, buy USD/JPY?

China to impose more tariffs on some U.S. goods from 6 July onwards

US President Donald Trump’s new trade tariffs on China will lop the modest US growth and add a similar amount to inflation which is a small amount for its 19 trillion-dollar economy that is experiencing its second longest economic expansion on record. However, Trump’s tariffs may also influence his efforts to bring peace to the Korean peninsula following his summit with leader Kim Jong Un this week in Singapore. China is an important player in talks with North Korea in abandoning its nuclear-weapons program.

On Friday, Trump imposed tariffs on 50 billion US dollars of imports from China, a move that came on top of hefty duties on steel and aluminum imports implemented at the start of June. China quickly responded to US President Donald Trump’s announcement of tariffs on the $50 billions of imports from the nation which left the global economy on the verge of a trade war.

The costs have been manageable so far, with Commerce Secretary Wilbur Ross saying that the metals tariff, for example, will add a few hundred dollars to the cost of a car. Trade retaliation from China has so far been mainly confined to the farm sector, which is a small part of the overall US economy.

That could change if Trump pushes ahead with more protectionist measures, possibly triggering a stock market sell-off that would damage business and consumer confidence. This came at a time where the Fed has pushed interest rates into positive territory adjusted for inflation for the first time in over a decade, a move that will raise borrowing costs for consumers and business.

On the euro side, euro sank after the ECB pledged to keep interest rates unchanged at current record lows at least through the summer of 2019, offsetting any hawkish bias from its decision to halt its bond-buying program at the end of this year. After Mario Draghi dashed expectations that the ECB could tighten for the first half of 2019, investors with long cash exposure in the euro ran for the exit. At the same time, option traders opted for carry as shorts in the common currency in the medium-term made sense given that Fed signaled on Wednesday its intention to hike this year once per quarter.

For this week, with little top-tier global economic data to digest, traders will be on the lookout for any signals from policy makers who have speeches lined up domestically and also European Central Bank conference in Portugal.

Our Picks

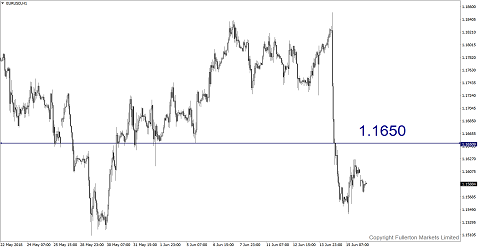

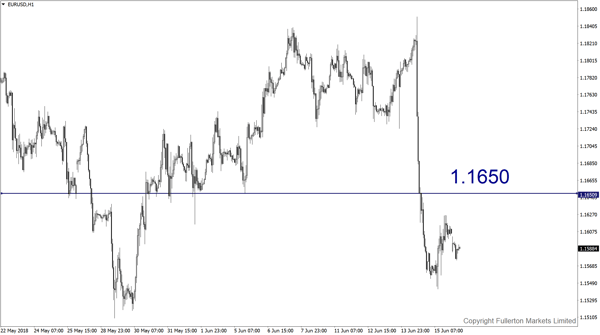

EUR/USD – Slightly bullish.

This pair may be oversold last week and may rebound towards 1.1650 this week

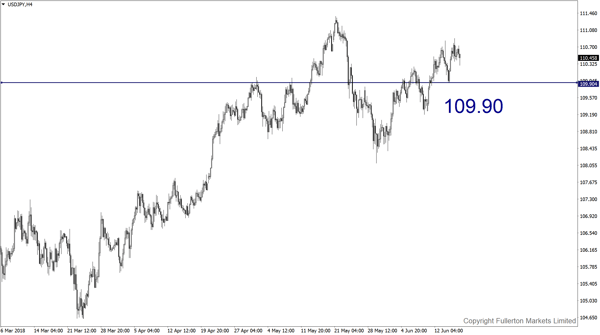

USD/JPY – Slightly bearish.

We expect this pair to fall towards 109.90 amid US-China trade tension which could potentially escalate.

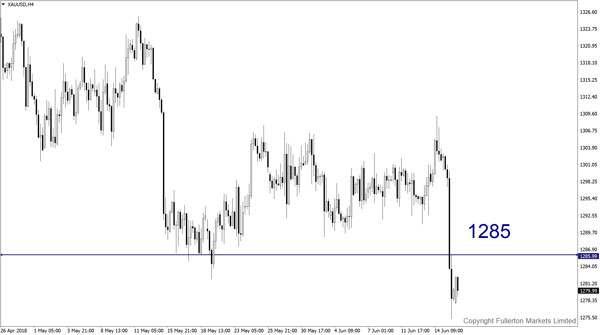

XAU/USD (Gold) – Slightly bullish.

We expect price to rise towards 1285 this week.

Fullerton Markets Research Team

Your Committed Trading Partner