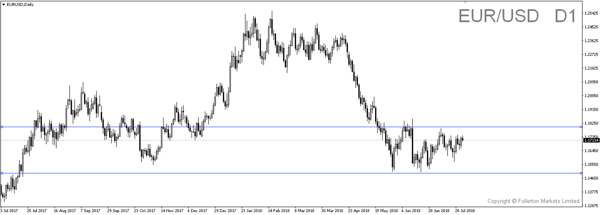

As CPI and trade activity are weakening, Short EUR/USD?

After a dovish meeting in June, ECB is expected to keep rates unchanged as President Draghi mentioned he is not looking at any rate hike until late 2019. ECB also announced the tapering of asset purchases in June. Though, there were reports citing a split on letting rates remain unchanged till 2019 as some members are looking at one more rate hike this year.

The latest PMI reports released this week was mixed with manufacturing sector growing while the services sector slowed. Euro CPI remained unchanged coming out at 2% while trade balance surplus was below forecasts as exports fell. Investors remain pessimistic as the slowdown in economic activity could be worsen after tariffs from US becomes a reality.

President Draghi mentioned that global factors, including the threat of increased protectionism continues to threaten the growth of the Euro economy. The situation now did not improve as US are looking to impose a car tariff retaliation of about 20% which could lead to continued slowdown in the Euro economy.

However, President Draghi might be relatively balanced in his tone or even leaning towards hawkishness when he speaks during the press conference after the interest rate announcement. This could be due to the previously mentioned forward guidance being just a guide for ECB instead of an actual route ECB is taking .

The dollar was experiencing a roller coaster ride since last week as Trump’s dovish comments on a strong dollar whiplash the dollar lower. The US Core Durable Goods Order tonight could boost the dollar as we have a stronger manufacturing ISM index.

EUR/USD is currently trading at a tight range but if market feels that President Draghi’s speech is hawkish, we could see 1.1800 price zone to be taken easily. On the other hand, if his comments are seen dovish, we could see this pair falling to 1.1500.

Fullerton Markets Research Team

Your Committed Trading Partner