Do you want to improve your financial situation? Invest.

Do you want to boost the growth and health of your wealth? Invest.

If you have been investing for some time, you're likely to have experienced the many benefits that come from a range of investment options. These include an additional income stream to rely on, financial freedom, and easy access to fundamental resources. But can you consider yourself a seasoned investor?

Take the test

Time and experience are two metrics that can help gauge if you're a market veteran. They don't present all the details, however. So here's a test that can help identify if you belong in the seasoned category. Just answer YES or NO.

- Do you have the mental discipline to stay strong and not crumble during recessions or large corrections that result in asset price declines of 30% or above?

- Can you articulate why you choose the stocks you own in your investment portfolio?

- Do you sleep soundly even with large price declines of short-term investment options?

- Do you focus more on long-term prospects and actually hold stocks and bond funds for a decade or longer?

- Do you remain emotionally secure when you have a failed investment because you weighed the risks and rewards before you invested in it?

- Do you understand the difference between investing and trading?

- Are you aware of the tax implications of different investment options?

- Do you have mixed feelings about fast-rising markets and get excited about markets in correction phases or those more volatile ones?

- Do you see opportunities in tumbling markets?

- Do you know how to manage risks?

- Do you have a specific allocation strategy in place?

- Do you make investment decisions based on risks, potential returns, costs, taxes, and the reasons you're investing?

- Do you buy when everyone else is selling or decide to buy or sell without being influenced by what is going on in the market or the price you invested in a specific vehicle?

- Are you emotionally and mentally prepared to see bad results from your stock portfolio over a five- or 10-year period and still stick with it?

- Do you diversify your portfolio with bonds and stocks and avoid investing in narrow market sectors because you are fully aware of the unpredictability of the market and the challenges of earning market-leading returns?

If you’ve answered YES to most or all of these questions, then you're a veteran in the world of investing. So no need to read further.

Then again, you might discover useful information in this post that you can apply in your next investing adventure.

If you're looking to gain more experience and develop grit in maximising returns from the best investment options, we're here to help.

Check out: How to Become Financially Independent This 2020 (and Stay Out of Debt)

At the end of this post, you will learn how seasoned investors think and operate.

Quick Navigation

- Set the foundation to become a market veteran

- Build an investment portfolio

- Develop a winning investment strategy

- Plan for your investment future

- Short-term vs long-term investment options

- What are safe-haven investment options?

- Identify the best investment options for 2020

How to set the foundation to become a market veteran

Before you become a seasoned investor, you must first lay the groundwork for investing success and better management of your portfolio. Because risks are an integral part of investing, the foundations you set will cushion you from the mental and emotional stress that comes with this financial activity. Properly set, you can smile through stock price declines and celebrate over big returns.

Create an investment plan

Just like building a skyscraper, you need a plan that will guide you in navigating the complex world of investing.

In creating one, ask yourself the following questions:

What is your goal or purpose in investing?

For investment income

This is where you receive periodic payments of dividends or interests from the investment you make. The money you earn you can choose to spend, re-invest, or to help cushion you from the roller coaster ride of a growth-oriented investment.

For growth

This refers to growth or capital appreciation of the value of your investments. The idea is as simple as selling an investment vehicle for more than what you paid for it.

For stability

Also known as protection of principal or capital preservation, investing for stability focuses more on maintaining the value of your investment rather than increasing or losing it. This is a primary investment goal for people who plan to earn money quickly and have the ability to access the money when they need it.

How much are you willing to invest realistically?

Make sure to only invest money you don't need or can spare, or you might end up in a financial bind. Never borrow money for investment purposes, either. How will you pay it back if your investment fails? So sit down and determine how much you can set aside for investment purposes. Consider:

- Minimum investment amount required

- Investment frequency (monthly, quarterly or annually)

- Frequency of payouts

- Rate of returns

- Investment options to spend your money on

How long before you're going to need your capital back?

If you need the money you invested back in a year or two, for example, you should create the appropriate investment plan. A good option would be to put money in short-term and safe investment options such as online checking accounts and short-term bond funds.

The same is true if you are investing for your retirement. In this case, you need to consider your age and choose an investment option that will pay you back within a specific timeline. For instance, you only have 10 years before you hit the big 6-5 and you want to have a substantial nest egg. Invest in vehicles with a 10-year payout such as rental real estate, bonds, variable annuity, and dividend income funds.

How much risk are you willing to take?

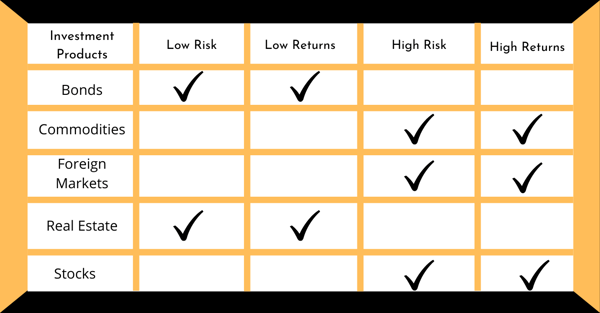

When investing, there's always the risk of you losing money. But you can keep the damage to a minimum if you choose investment products wisely.

Invest in low-risk or safe, no-risk investments. Don't expect too much ROI, however. If you want to earn big, take the risk and put your money in higher-risk investments. Take the time to discover your risk tolerance and invest accordingly.

How will you know what investment product to put your money on?

The answer will depend on your investment purpose, the amount of money you can set aside for investing, risk level, and the time frame between when you invested your money and your first anticipated withdrawal. This is where you put together your plan based on the factors above.

Purpose: Stable ROI

Amount to invest: $100,000 a year

Time frame: First anticipated withdrawal in five years

Risk level: Low risk

Investment product to invest in: Short-term bonds (corporate, government, and municipal bonds)

Now that you have an investment plan, make sure to stick with it. But leave room for changes here and there.

Determine the investment fees you’ll have to pay

When investing, there are operational expenses and other fees to pay. This can be taken out of your account or deducted from your investment returns. So don't expect the amount you invested to all go into the stock or bond fund you bought.

- Ongoing operating expenses

- Transaction Fee: Usually charged by brokerage accounts as payment for buying or selling a mutual fund or stock.

- Fees for investment management or advisory: The percentage of your total assets managed will be deducted as an investment management fee. This can be tax-deductible or partially paid with pre-tax.

- Expense Ratio: This refers to the operating expenses involved in putting together a mutual fund. Fees are deducted from your investment return.

- Annual Account Fee: This is charged by mutual fund and brokerage accounts.

- Annual Custodian Fee: This is payment for reporting on retirement accounts and as a closing fee when terminating your account.

- Front-end Load: This is a commission charge for Class A mutual funds.

- Back-end Load or Surrender Charge: This is charged on Class B mutual funds. Also known as a surrender charge, it is deducted at the time of sale. The amount decreases for each year that you own the mutual fund.

How to build your investment portfolio

Every investor must have a financial portfolio. After all, this is where all your assets are held. The lack of one can mean lost opportunities for income growth and for being unprepared for major milestones. Think of a portfolio as a shopping list, complete with pros, cons, and other pertinent details. In creating a portfolio, there are certain aspects you must focus on.

Time Frame

How soon do you need the money? Different investment options have different payout periods.

You can earn in as short as less than five years from short-term investment options, but you're looking at a five-year or decade-long wait for long-term ones. So think about whether you need the money back in less than five years or after ten years.

Savings Capacity

How much can you set aside for investment? This is usually between 10 and 15% of the income you earn annually. Make sure to lock in this much of your income for investing. Should your income increase, the savings rate should also increase. Say you're paid 4% higher this year, your savings rate should go up 4% as well.

Risk Tolerance

As mentioned, investing comes with risks, even those dubbed as safe investment options. The level of risk you can tolerate will dictate the kind of financial products to include in your portfolio. Remember, the higher the risks, the higher the returns.

Based on five-level risk tolerance, your investment options include:

- Cautious - Money Market

- Conservative - Bonds, ETF

- Balanced - Bonds, ETF, Income Stocks

- Moderate - Growth Stocks, Income Stocks

- Aggressive - Growth Stocks, Income Stocks, Small-Cap Stocks

Social Values

Some investment products pay you money at the expense of other people and the environment. Mining, for example, is largely destructive and also puts miners at risk of accidents. Think about investing in vehicles with social value and that enables you to contribute to the community.

Active vs Passive Investing

With Forex investment, for example, trading can be a minute to a 24-hour long affair. You may or may not monitor the market frequently or stay glued to your screen as the numbers change. The same is true with other investment products. You can take the DIY route or hire a fund manager to handle your assets.

Based on the data above, you can then tailor your investment portfolio to your goals. It can look like this:

Time frame: 20 years or more

Savings Capacity: $50,000 per year

Risk Tolerance: Medium

Social Values: Assets with a positive value

Investing Style: Hands-off

A potential investment option? Bonds (20%) and Stocks (80%). Now that your investment portfolio is set, the next step is to keep improving it.

- Cut back on expenses so you can put more money towards investments.

- Check out foreign investment opportunities and combine them with domestic ones.

- Play around with 5 to 10% of your portfolio, investing in slightly riskier products rather than sticking to safe investment options over the long term.

It's important to note that no two investors will have the same investing goals. So create your own portfolio independently, rather than copy from someone else.

Here’s what a profitable portfolio looks like.

Options for investment diversification

When there's a good mix of assets in your portfolio, you can earn the highest return with the least amount of risk involved. A common mixture includes fixed income, commodities, and stocks. When you diversify, you protect yourself against certain risks present in some assets.

Even in the same economic event, different assets react differently. When there's economic growth, stocks perform well. When the economy slows down, bonds perform well. Therefore, if you have a good mix of stocks and bonds, your portfolio is sound despite the economic ups and downs. Thus, the importance of investment diversification.

Now, which asset classes or investment options can help diversify your portfolio?

- Stocks from small-cap, mid-cap, and large-cap companies.

- Domestic fixed income such as money market funds, municipal bonds, corporate bonds, and short-term bond funds.

- Foreign fixed income that is issued by both companies and the government. This protects you when the dollar weakens.

- Foreign stocks provide great diversification because you have access to both developed and emerging markets.

- Commodities include oil, real estate, gold, and other natural resources. As a safe-haven investment, adding gold to your portfolio will protect you when the stock market crashes.

Say you invested in all of these asset classes, how much of your money should you allocate to each? The answer depends on your goals, risk capacity, where you are in life, and the returns you want to earn. If you want to see returns in the next couple of years, for instance, allocate more to bonds.

How to choose the best investment vehicles

Each investment product has its share of pros and cons, which you must analyse to help identify the best investment option for you.

Between bonds and stocks, for instance, the former is often considered a safer option. However, if you compare dividend stocks vs. bonds in terms of risk-adjusted returns, equities may offer superior total returns.

But let's keep things straightforward.

Are you willing to take the risk for higher returns? Or, are you more comfortable receiving lower returns as long as you don't have to take major risks?

As for Forex investments, there's a reward-to-risk ratio that you must hit to get higher returns. This makes Forex trading investment a bit more challenging than other financial products.

Experts recommend a 3:1 reward-to-risk ratio to make a significant profit. Expect to lose leading up to this.

Out of your 10 trades, for example, you're looking at five losses. But because your winning percentage is higher, you will have a profitable trade. For every $1,000 loss, for example, you can win $3,000.

If you want higher returns with every loss, you should know how to invest in Forex and add it to your investment portfolio.

Developing an investment strategy

Be guided by the following considerations:

In developing a strategy, you take into consideration the same factors when you created an investment plan.

You still look into:

The timeline from when you first made an investment to your first payout. Do you need the returns in five years or less, or in ten years?

The level of risk you can tolerate, which will dictate the kind of financial products to invest in. Bonds if you want to play it safe, for example.

Of course, if you want higher returns, you may need to stomach all possible risks and invest in high-risk products.

You should also think about how to implement your investment strategy. Are you going to be a hands-on investor or leave the intricacies of investing with a fund manager?

In addition to these, you also need to consider tax implications on your investments.

- Pre-tax investment vehicles are those with tax-deductible contributions, such as IRAs and 401ks.

- After-tax investment products are those where you pay income tax on them. These include taxable brokerage accounts, CDs, money market accounts, and savings accounts.

Then, there's a third category where the proceeds are tax-free but use after-tax contributions. A good example is your primary residence's home equity. Based on these aspects, it will be easier to analyse which investment strategy to employ.

Investment strategy analysis: Finding a tactic that works for you

Most market veterans follow tried-and-tested tactics for investing. You should too if you want to become a seasoned investor. The strategy you choose would still depend on your goals, risk tolerance, and timeline, rather than solely on returns. What are some of your options?

Robo Advisors

Simple and straightforward, Robo Advisors are low-cost software products that allow you to manage your portfolio on autopilot. It is recommended for professionals, beginner or young investors, investors who want to employ simple strategies, and those who don't want to hire a financial adviser.

Pros

- No need to consult a financial advisor

- Easy to use and tax-efficient

- Automated process

- Investing mistakes are avoided

- Invest a smaller amount for a lower fee

Cons

- Lack of good financial planning

- Costs more than other all-in-one funds

- Does not guarantee great performance or returns

Value Investing

This is the tactic employed by value investors who are also called bargain shoppers. What they do is to look for stocks with prices they think do not fully reflect a security's intrinsic value. The ultimate example of a value investor is Warren Buffett, who invests in businesses rather than stocks. This means he does his research for years, looking at the bigger picture and not just on a company's temporary knockout performance.

Pros

- Spectacular gains because you can buy underpriced stocks and sell them above intrinsic value

- Favourable risk-reward ratio (low risk, high returns)

- Follows a fundamental analysis rather than based on emotions

- Investments are placed on reliable blue chips

Cons

- Estimating and identifying a stock's intrinsic value requires expert knowledge

- Not for short-term investors or those looking for a quick payout

- Long-term waiting can lead to a no-win situation

- Requires self-confidence and courage to row against the flow

- Increases the risk of a poorly diversified portfolio

Growth Investing

This strategy uses fundamental analysis, where investors look into a company's financial statements and business metrics to see growth potentials. Although time-intensive, this is the investing strategy that most professional fund managers use.

Pros

- Quick appreciation of successful investments, usually faster than the overall market

- The investment focus is on companies with above-average sales growth and earnings

- High exposure to industries that are cutting-edge and rapidly evolving labour

Cons

- High risk and volatile

- May or may not pay dividends because earnings made by growth companies are commonly reinvested

- Requires a lot of time to evaluate growth projection estimates and their credibility

- Projected valuations that are usually much higher than the market average may never materialise

Momentum Investing

Among the many investment strategies, this one is the most exciting but not for the weak of heart. Momentum investors only buy stocks that are showing an uptrend and then short sell those securities. Basically, they ride the wave but conduct technical analysis on every investment product.

Pros

- Buy high, sell higher

- Involves securities with growth potentials

- May not require monitoring when you employ stop loss and trailing stop order

Cons

- Tendency to lose big when the stock reverses itself

- High degree of turnover

- Tax inefficient

- Big losses during market transitions

- Risk of a momentum crash

Dollar-Cost Averaging

This strategy involves making regular investments every month over a period of time. For instance, you put $300 in certain stocks every month. This disciplined approach allows investors to capture prices at all levels, whether high or low.

Pros

- Easy to budget because you're investing a fixed amount each month

- Purchase more shares when the price is low

- Acquire stocks that make the average price per share within a year

- Gets you in the market and earning returns rather than waiting for the right moment to invest

Cons

- Delays the process of fully investing in your asset allocation

- You may be holding cash without returns, instead of investing all of it and earning (or losing)

- Does not reduce market risk, only delays it

Buy and Hold

This is what many seasoned investors do. They buy low and sell high, but only when the time is right, which is the exact opposite of what many investors commonly do. Experienced traders jump in and out of a stock and make money in the process. This can be disastrous for the inexperienced, especially with the risks involved and tax consequences.

Pros

- Proven to work and earn exponential gains

- Does not require in-depth technical analysis

- Investing is based on cold, hard facts

- Tax at a long-term rate that is more favourable

Cons

- Capital is tied up because you hold the stocks for a certain period

- Time intensive, with assets held for 10 years or so

- Results in major losses when the market crashes

Planning for the future

Seasoned investors don't just monitor the performance of their investment options or focus on the returns of their Forex investment. They also ensure their asset allocations and their portfolio continues to perform well and with as few tax consequences as possible.

Reduce taxes with investing

When you invest in more than one account type, you also diversify tax-related activities. Remember that investment accounts are either taxable or tax-deferred. A good mix would mean it won't hurt as much if you’re taxed on dividends because you have investments that grow tax-free until returns are withdrawn.

Rebalance

Because of how market performance changes over time, you should leave room for a few tweaks and improvements in your portfolio. You may need to increase your asset allocation on stocks and decrease those on bonds to get back into balance. You may need to sell some stocks and hold others. Rebalancing is simply giving your portfolio a tune-up for a favourable outcome.

Neutralise inflation

Among the many investment options, long-term bonds are the most vulnerable against inflation. Avoid a long-term bond portfolio to mitigate losses. Instead, invest in products with their own pricing power. The rental cost of real estate, for example, increases when prices increase. Another safe investment option is commodities that are independent of currency movements, such as gold or oil.

Protect against declines

A market downturn can happen, sometimes without warning. This is why seasoned investors protect themselves against impending downturn by:

- Investing more in products with fixed income

- Hold and hoard cash when a downturn is coming

- Resume reinvestments once the storm has passed

- Liquidate investments that are high risk or in risky positions

Saving for retirement

Financial security upon retirement is one of the goals of investing. With the right calculation, you will earn enough returns that you can use for the rest of your life. You should also explore time segmentation to earn returns at specific ages and timelines.

Comparison of short-term and long-term investment options

Long-term investments are vehicles that are held for more than a year or for several years.

- Stocks

- Long-term Bonds

- Mutual Funds

- ETFs

- Real Estate

- Annuities

Short-term investments are vehicles that are held for one year or less.

- Online Savings Account

- Short-term CDs

- Online Checking Account

- Cashback Credit Cards

- Peer-to-Peer Lending

- Stocks

- Short-term Bonds

Both of these investment options carry different expectations, will satisfy different needs at different times of your life, and meet different goals and risks. This is why seasoned investors include a good mix of short- and long-term vehicles in their portfolio. Doing so will keep their asset allocation balanced and protect them against fluctuations, volatility, and other risks.

Safe-haven investment options

While there's always a level of risk linked to investing, there are some investment vehicles that are considered safe haven because they can retain or increase in value even during turbulent times in the market. This doesn't mean they're invulnerable in other down markets, however.

Gold

As a physical commodity, gold is considered a store of value for many years. It is not affected by interest rate decisions made by any government and often serves as a form of insurance when adverse economic events happen. The value of gold increases during a threat of inflation, making it a profitable investment vehicle.

Check out: Investing Tips: 5 Reasons Why You Should Trade Gold Now

Utilities

Utility stocks are anything that is essential and useful such as electricity, gas and water. The returns may not reach historical highs but income is slow and steady. What is even better is that these vehicles can weather through a recession and whatever state the market is in.

Real estate investment trusts (REITs)

Because of high dividend returns, REITs are often used to increase the yield of an investor's portfolio. The total return of the S&P Asia Pacific REIT Index last 2019 was 23.01%, 4.29% higher than the total in 2018. When real estate prices weaken, however, REITs also become a riskier equity investment.

When are safe havens not safe?

Despite being dubbed as safe-haven investments, there are still related risks. The price of gold, for instance, can drop significantly when the global stock market drops. The only consolation is that you can sell gold for cash.

How do safe-haven assets apply to Forex trading?

There are currencies that are considered safe havens, which is why currency traders and investors would protect themselves from a volatile market by converting holdings of cash into these currencies. The Swiss franc is a top safe-haven and stable currency. The Japanese yen, Euro, and the US dollar can also fall into this category, depending on the challenges the market faces.

Identify the best investment options this year that will meet your objectives

An investor makes an investment to achieve some goals and objectives. It can be anywhere from capital preservation to higher income. What are some of the best investment options for you this 2020?

Stocks

The stock market is every investor's playground where they get to buy common or preferred stocks, gain shares, and become part owners of different companies. Although riskier than other investment vehicles, the high returns make stocks suitable to meet goals of growth and liquidity.

Exchange-traded Fund

ETF is a mix of investment vehicles, including bonds, commodities, and stocks. It's traded on a stock exchange but is more closely related to a mutual fund. The only difference is that share price changes throughout the trading day when investors buy and sell shares. Those who invest in ETFs are after liquidity, income generation, price increase, and to offset risk in their portfolio.

Real Estate Investment Trusts (REITs)

With returns over the long term, REITs are sure to meet your goals of steady, low-volatility income growth. It can rebalance your portfolio in the event of a stock market crash.

High-yield Savings Account

Invest in this vehicle if you want to play it safe while earning a good yield. Use the returns to supercharge your retirement savings or maintain positive cash flow.

Growth Stocks

Apart from income generation, growth stocks also provide you with revenue and dividends to satisfy your goal of increasing your income. These also provide you with an opportunity to improve your portfolio.

Yourself

Not exactly an investment vehicle, but failure to invest in your growth and health would mean an inability to meet your investing objectives. Think about it; if you don't acquire new skills that will help you in your career, you won't have the extra funds to invest. So make sure to invest effort, time, and money in yourself.

Check out: 5 Things You Won’t Regret Investing In

Conclusion

We've given you the tools to cultivate the seasoned investor in you. Now, it's your turn to put them into practice and use them in your favour.

It will take years to become a market veteran. At least, for some investors. Your story could be different.

Don't forget to share with us your experience as you put these strategies into action.

Looking to grow your investments and generate income in the world's largest financial market? No better place to start than right here with us! Start trading with Fullerton Markets today by opening an account:

You might be interested in: 3 Things Entrepreneurs Must Value