Editor's Note: This blog post was posted on June 28, 2019 and was updated for accuracy and comprehensiveness.

Most Forex traders would have come across this phrase somewhere along their trading journey: “The trend is your friend until it ends.”

Many make the mistake of trading in all market conditions, resulting in a loss because their strategy didn’t work during certain periods. This mostly happens when the market is erratic or too choppy, which reduces your trading accuracy and effectiveness.

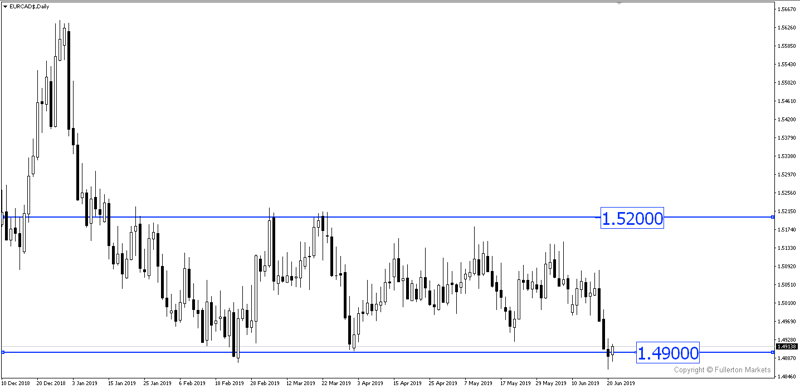

Below is an example of a ranging market (EUR/CAD) that has been ranging in the 300-pips band.

The ranging market of EUR/CAD

However, it’s a fact that markets are not always trending. So we need to know how to adapt to changing market conditions.

In this article, we’ll talk about how to identify a low volatility market and what you can do to trade effectively in the Forex market even when it’s slow.

What is low volatility trading?

In trading, volatility is a measure of how prices or returns are scattered over time for a particular asset or financial product.

Volatility creates profit potential, so most traders prefer trend trading because of the large volatility and potential for greater returns.

Conversely, when the market has low volatility, profitability is also lower. This is why traders are more cautious in such conditions.

How do we determine low volatility?

There are three ways to determine low volatility.

1. Determine top and bottom

In a trend, we always have a series of higher high and higher low (uptrend), as well as a series of lower high and lower low (downtrend).

So when the market does not specify a series like this, it means that a range is forming.

To define the range, consider two bounces from the top of the range and two from the bottom (as marked by the yellow lines below).

Learn more about range strategy and The 3 Laws of Successful Trading.

2. Use the Bollinger Bands indicator

Bollinger Bands are a familiar indicator used by traders. When the Bollinger Bands narrow, we will see that the market will have low volatility.

Here's a guide on How to Trade with Bollinger Bands.

3. Use the Average Directional Index

The Average Directional Index (ADX) is an indicator that measures market volatility. An ADX that is below 20 shows that the market has low volatility.

Which strategy should we use in low volatility markets?

In a low volatility market, traders find it more difficult to find profits.

But there are five things you can do if you encounter a market period of low volatility.

1. Take a break

The fastest way to make money is, in fact, through capital preservation. Most traders do not preserve their capital long enough to make substantial profits. So, if the erratic market conditions do not suit you, don’t trade during that period.

You should take a week off, and your money will still be there. Remember, don’t be compelled to trade all the time.

2. Trade using a lower timeframe

You can simply apply the three methods of determining low volatility mentioned above. Instead of using them for large timeframes, trade with a lower timeframe.

3. Use a range-bound strategy

This could be the most straightforward answer ever. Consider utilising a range-bound strategy in a ranging market but do note that low volatility in a ranging market produces the most erratic false breakouts and stop hunts. One must then adjust their stop loss (SL) and lot size accordingly.

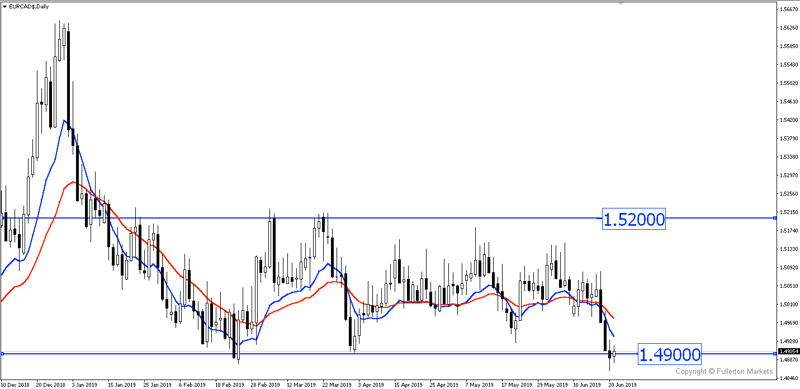

So, how do we then determine whether the market is ranging? A powerful tool that some traders use to check market conditions is the Exponential Moving Averages (EMAs). A ranging market is indicated by not-so-obvious support and resistance, as well as candles that are not moving in a clear direction.

Below is an example with the blue line as the 8-day EMA and the red line as the 21-day EMA. You can see that the EMAs have no clear direction and are cutting into each other frequently.

The Exponential Moving Averages (EMAs) Graphic

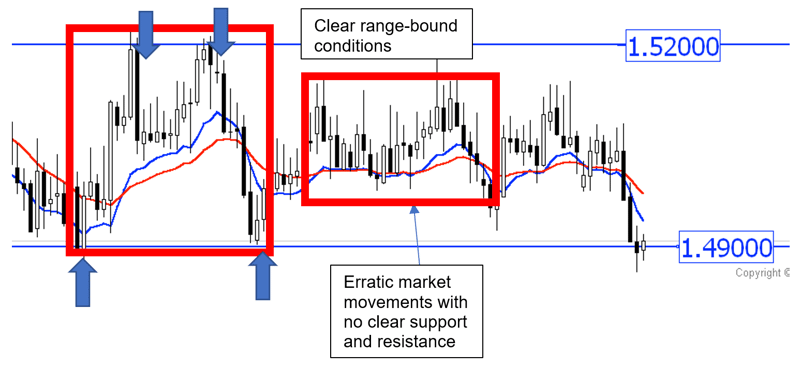

If we zoom in, we can find a good ranging period and a choppy period from the charts below.

A good ranging period and a choppy period

Another alternative is to draw support and resistance levels from the previous highs and lows. Then, we might find reversal candlestick patterns at resistance and support areas to trade.

You can use overbought-oversold indicators such as Relative Strength Index (RSI) and Stochastic for support.

4. Use a breakout strategy

After a range, markets often tend to break resistance or support and form trends.

Wait for the candle to close above resistance or below support. You can enter orders Buy or Sell with SL = ½ Range.

Note that you must always have a stop loss in place as markets often have failed breaks.

5. Focus on small trades

With low volatility markets, do not expect to have large orders, so focus on small orders with a trading risk-reward ratio of 1:1.

Also, remember to repeat trades that work for you. Pick one side to trade and trade on that side until it stops working for you.

In conclusion, a low-volatility market may not be the most ideal market to trade in as the market is not certain as to which direction to move in. The best thing you can do is to not trade at all until a clear direction is seen or when you can determine clear range-bound conditions to utilise your range-bound strategy. Remember to trade on smaller timeframes and repeat those that work for you.

Ready to grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: Why Keeping a Trading Journal Matters According to Stock and Forex Traders