If lower China’s bonds prices mean higher stocks value, do we long AUD/USD?

Chinese regulators are moving to control leverage in the market by capping bond-trading firms' repo activity as reported by Economic Observer. They seemed to be making it tougher to buy bonds with borrowed funds. Is that good news for AUD/USD?

- PBOC, CBRC, CSRC and CIRC issued new rules to regulate bond trading, as reported by Economic Observer. The rules will cap bond trading institutions’ outstanding repurchase repo and reverse repurchase repo.

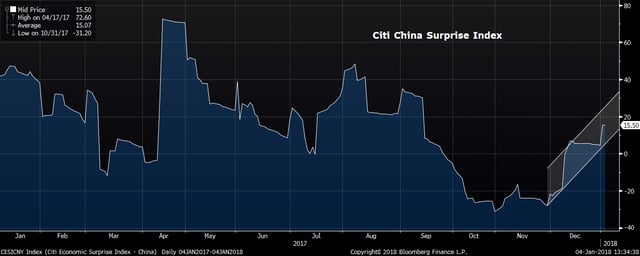

- For its economy, China’s official factory PMI maintained momentum, which signaled campaigns to reduce both pollution and debt risk which haven’t curbed growth. Citi China Surprise Index bottomed in November last year and better-than-expected economic condition also increases the downside risk for bonds prices.

- Lower bond prices in China could mean higher stocks prices due to its “closed capital market” nature, as over 90% investment flows there are from domestic.

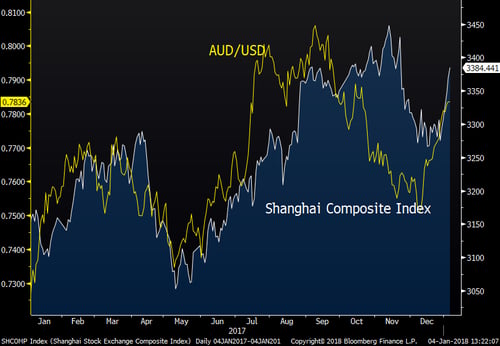

- Stocks outlook seemed to be getting brighter in 2018 due to better than expected growth and a pessimistic bonds market. Shanghai Composite Index had been rising for 5 days, one of the longest gaining streak since November last year.

- The graph below shows that AUD/USD has been moving alongside with Shanghai stocks for past 12 months.

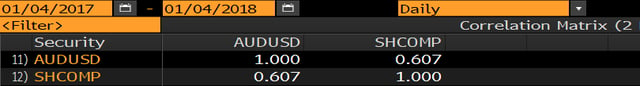

- A separate graph shows the correlation between the two at 0.607

Fullerton Markets Research Team

Your Committed Trading Partner