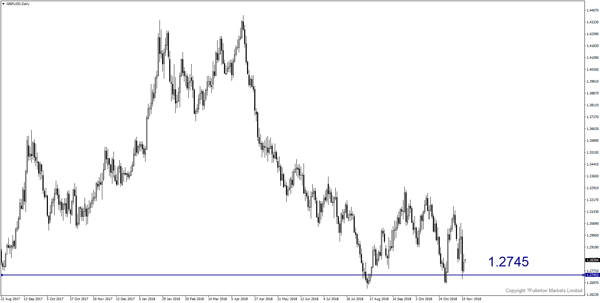

If there is no deal in the UK this week, GBP/USD may continue to fall.

Serious financial disruption in UK looks real for now

The British pound could tumble another 3-4% following the resignation of UK’s Brexit Secretary Dominic Raab, increasing risks to Prime Minister Theresa May’s leadership and the potential for a “no deal.”

Investors are the most bearish on the pound in more than two years, since the UK voted to leave the European Union. Markets braced for the possibility of a no-confidence vote on Prime Minister May. The premium to buy put options on the currency relative to calls is the steepest since June 2016, with reports indicating seven leading Conservative lawmakers preparing campaigns to oust her. A confidence vote could come as soon as this week.

UK politicians received a first view last Thursday of the financial market turmoil, that may be triggered if they fail to approve the Brexit deal struck with the European Union. Nothing looks pretty: a drop of almost 2% in currency markets; banks, builders and utilities tumbling around 5%; rising credit risks and a debt sale that was pulled. These are the sort of moves that draw comparisons with emerging market economies. And volatility markets point to the possibility of things getting much worse before they get better.

The assumption that a Brexit deal will be reached and ratified by all sides has now been called into question. Before a deal happens, we are likely to experience the threat of a no deal, causing serious financial disruption, and a possible business and consumer confidence shock. If lawmakers reject the deal, it could ratchet up pressure on a divided parliament. Remember the 6% flash crash in October 2016 when the pound was pummelled in just one minute in thin Asian trading?

Another key event will be the G20 summit this week. US Vice President Mike Pence sharpened attacks on China during a week of summits that ended Sunday, most notably with a call for nations to avoid loans that would leave them indebted to Beijing. He said the US was not in a rush to end the trade war and would not change course until China changes its ways – a worrying prospect for a region heavily reliant on exports.

Our Picks

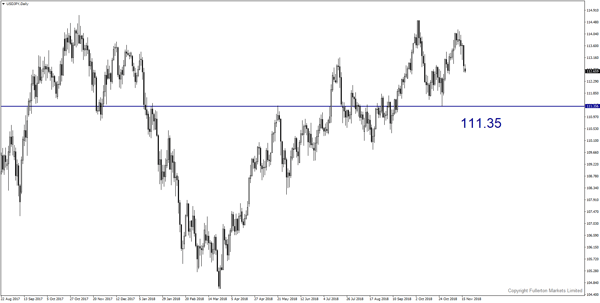

USD/JPY – Slightly bearish.

Risk sentiment is likely to be contained this week ahead of the G20 meeting. USD/JPY may fall to 111.35 this week.

GBP/USD – Slightly bearish.

GBP volatility remains high which means uncertainties will continue to weigh on the currency. This pair may drop towards 1.2745 this week.

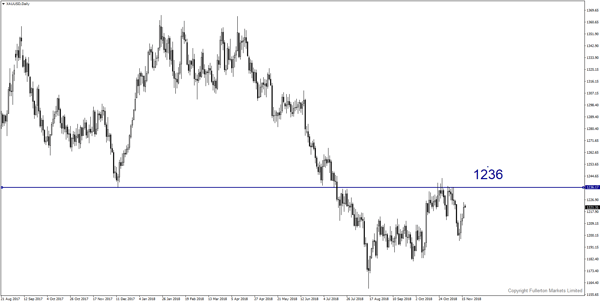

XAU/USD (Gold) – Slightly bullish.

We expect price to rise towards 1236 this week.

Fullerton Markets Research Team

Your Committed Trading Partner