For the First Time in Decades – Fed’s QE Jitters Investors

- March 16, 2020

- | Fullerton Markets

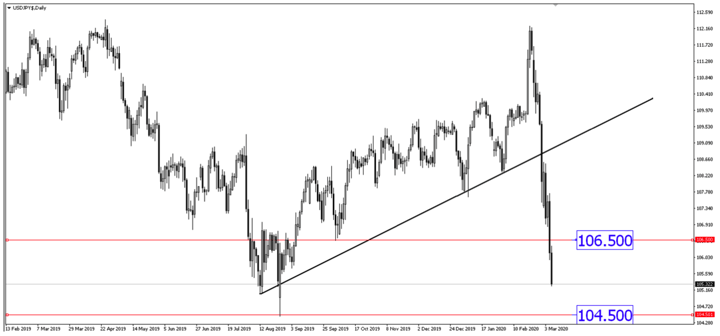

Market sees no short-term solution to combat the virus, short USD/JPY at peak

Sneak Peek: All Eyes on ECB Tonight

- March 12, 2020

- | Fullerton Markets

Following European Central Bank (ECB) President Lagarde’s dovish comments yesterday that the impact of COVID-19 could be as bad as the 2008 crisis, we believe ECB may dish out stimulus to support the...

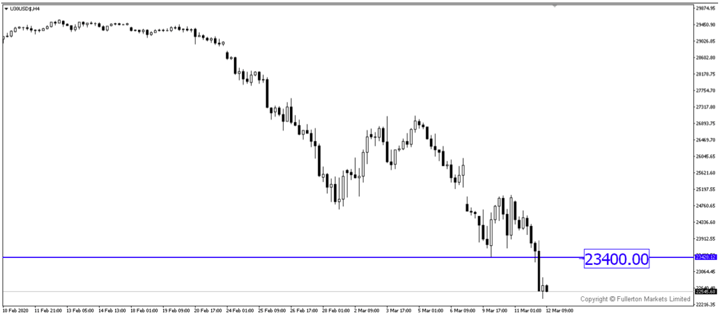

Breaking News: Dow Falls into Bear Market

- March 12, 2020

- | Fullerton Markets

With the World Health Organisation declaring the COVID-19 situation a pandemic and major central banks cutting rates, the sell-down may be far from over. Dow could fall further.

How to Become Financially Independent This 2020 (and Stay Out of Debt)

- March 12, 2020

- | Fullerton Markets

Who wouldn't want to be free of debt and have enough money to live a comfortable life? Unfortunately for many, they have more debts stacked up than money saved in the bank. This is the reality of...

Breaking News: Whiplashed in GBP/USD After Bank of England’s Emergency Rate Cut

- March 11, 2020

- | Fullerton Markets

Sterling losses were erased almost immediately after optimism from the fiscal support Bank of England is going to provide. It would be better to stay at the side lines for now.

3 Things Entrepreneurs Must Value

- March 9, 2020

- | Fullerton Markets

It goes without saying that to succeed as an entrepreneur, you must be willing to put in the time and effort. But making it as an entrepreneur is no longer restricted to making profits; a more well-...

Don’t Put Too Much Faith in Dollar This Time

- March 9, 2020

- | Fullerton Markets

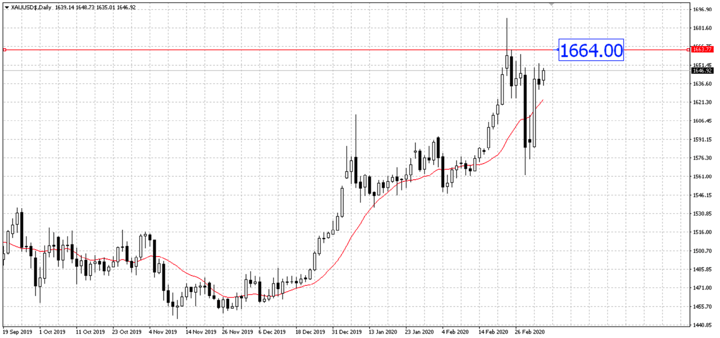

The market is in extreme risk-off mode, we recommend selling USD/JPY on peak and buying gold at dip.

Sneak Peek: How Will NFP Affect Dollar Tonight?

- March 6, 2020

- | Fullerton Markets

With the market moving into bear territory, even with a strong NFP data, the market might dismiss it as it doesn’t the true impact of COVID-19. Short USD/JPY?

Breaking News: BoC and Fed Cut Rates by 50bps, Who’s Next?

- March 5, 2020

- | Fullerton Markets

With both Fed and Bank of Canada cutting rates by 50bps, the rest of the major central banks may start to follow. Long XAU/USD?

Popular Read

Topic List

Open Account

Leverage |

: |

Up to 1:500 |

Spread |

: |

Starting as low as 0.1 pip |

Min Trade Size |

: |

0.01 Lot |

Support |

: |

24-hour (Monday - Friday) |