All About US-China Phase One Deal This Week

- January 13, 2020

- | Fullerton Markets

China Vice Premier Liu He will be flying to Washington today to commence phase one talks on 15 January. We could see a shift into risk-on sentiments this week.

Breaking News: Gold Rose to 2013 High After Iran Attacks Iraqi Base Housing US Troops

- January 8, 2020

- | Fullerton Markets

Iran’s retaliation could be seen to the US administration as an “act of war” which could further escalate the current conflict. Safe-haven bets could be your best bet.

Oil Rallies Put Risk Assets in Favour

- January 6, 2020

- | Fullerton Markets

As risk-off sentiments may be here to stay for some time, buy gold at dip?

Breaking News: Gold Rose to 4-Month High Amidst US-Iran Confrontation in Iraq

- January 3, 2020

- | Fullerton Markets

The move by the US to launch an airstrike on Baghdad’s airport could be the spark of a major escalation. Gold may retrace slightly back to 1537, finding support before moving higher towards 1553.

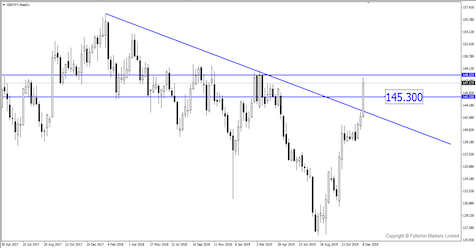

Beware of Breakouts Due to Low Liquidity This Week

- December 30, 2019

- | Fullerton Markets

As trading ranges typically expand during the new year week, we expect USD/JPY to move lower from a technical perspective.

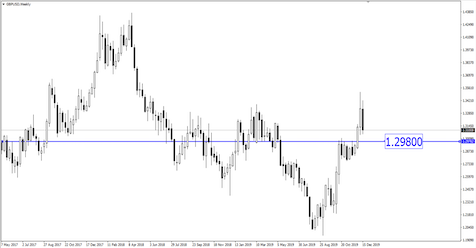

Renewed Brexit Uncertainty Could Resurface

- December 23, 2019

- | Fullerton Markets

As UK needs to race for trade deal with EU in next 11 months, short GBP/USD upon any rally.

Sneak Peek: BoE Could Hint Easing in 2020

- December 19, 2019

- | Fullerton Markets

While no changes in rates tonight, Bank of England (BoE) may hint a possible easing in 2020 due to tepid inflation. GBP/USD could fall lower.

How Far Can GBP Rise?

- December 16, 2019

- | Fullerton Markets

As the UK still has no trade deal with the EU post-Brexit, this is likely to improve risk appetite for GBP/USD in the forex market only for a short period of time.

Breaking News: GBP/JPY Rose 500 Pips After Boris Johnson Won Parliamentary Majority

- December 13, 2019

- | Fullerton Markets

With a majority Parliament won, PM Johnson will be able to get his Brexit deal through Parliament without further delay and take Britain out of the European Union. GBP/JPY could retrace first before...

Popular Read

Topic List

Open Account

Leverage |

: |

Up to 1:500 |

Spread |

: |

Starting as low as 0.1 pip |

Min Trade Size |

: |

0.01 Lot |

Support |

: |

24-hour (Monday - Friday) |