What Does Negative Interest Rate Mean?

- November 21, 2019

- | Louis Teo

To understand negative interest rates, we need to understand the mechanics of why central banks cut or raise interest rates.

Glad Tidings For Chinese Bond Market As PBOC Cuts Repo Rate

- November 20, 2019

- | Jimmy Zhu

The People's Bank of China (PBOC) recently lowered the seven-day reverse repurchase rate from 2.55% to 2.5%.

What Does China’s Rate Cut Mean for the FX Market?

- November 18, 2019

- | Fullerton Markets

Risk sentiment improved after China cuts rate, long USD/JPY?

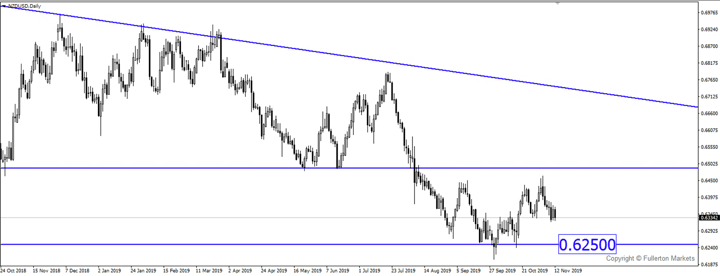

Breaking News: Sell Off in Risk-on Currencies Could Be Imminent

- November 15, 2019

- | Fullerton Markets

Antipodean currencies continue to weaken despite an improvement in risk sentiments as the slowdown in both Australia and New Zealand becomes evident through data.

Time-Deprived? Start Managing Your Time More Effectively

- November 14, 2019

- | Fullerton Markets

Time is limited and it’s a fact we must live with. There are exactly 24 hours in a day, 60 minutes in an hour, 60 seconds in a minute and so on. If you think it’s not enough then you’re probably...

Sneak Peek: What to Expect from RBNZ Tonight?

- November 12, 2019

- | Fullerton Markets

With RBNZ likely to cut rates tomorrow to 0.75% alongside RBZ’s current interest rates, NZD could remain dovish.

Risk-Off Sentiment Could Dominate This Week

- November 11, 2019

- | Fullerton Markets

President Trump said last Friday that he has not agreed to scrap tariffs on Chinese goods which dampened global outlook. Safe-haven currencies could strengthen.

Copy Tip of the Week – Top Pick of the Week (Nov 8)

- November 8, 2019

- | Fullerton Markets

The top CopyPip Strategy Provider for the week is called “The Quincy.” There are a few reasons why I’ve chosen this provider to be our contender for this week:

Sneak Peek: What to Expect from BoE Tonight?

- November 7, 2019

- | Fullerton Markets

With the backdrop of political chaos, slowdown in global economic growth and the delay in Brexit, some of the policymakers may vote for an immediate rate cut. GBP/AUD may continue its downtrend.

Popular Read

Topic List

Open Account

Leverage |

: |

Up to 1:500 |

Spread |

: |

Starting as low as 0.1 pip |

Min Trade Size |

: |

0.01 Lot |

Support |

: |

24-hour (Monday - Friday) |