Yen to Strengthen Amid Fed’s Policy & Risk-off Sentiment

- May 6, 2019

- | Fullerton Markets

With Fed’s rate cut discussion on the table, USD/JPY could continue to tank.

Sneak Peek: What to Expect from NFP Tonight

- May 3, 2019

- | Fullerton Markets

With ADP, jobless claim and consumer confidence favouring a stronger labour report tonight, EUR/USD could suffer further losses.

Copy Tip of the Week – How to Choose a Moderate Risk Strategy Provider

- May 3, 2019

- | Fullerton Markets

When we choose a moderate risk strategy provider, we look for a portfolio which is able to give us returns that are adequate while keeping volatility and risk at a level around 20% or less on equity.

Breaking News: Dollar Rallied After Fed’s Hawkish Tone

- May 2, 2019

- | Fullerton Markets

With Fed being one of the few central banks that aren’t hinting at a rate cut, this could create a monetary divergence between Fed and the rest of the central banks. EUR/USD could fall lower.

Dollar Could Fall Despite Stronger GDP Data

- April 29, 2019

- | Fullerton Markets

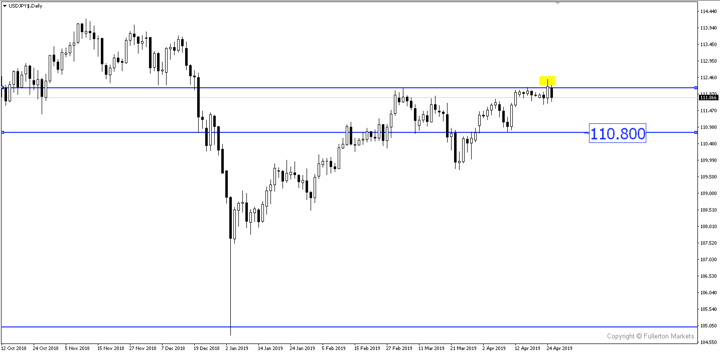

Fed may appear to be more dovish this week amid softer consumption demand, short USD/JPY?

Top 10 Trading Rules by Great Trader Jesse Livermore – Part 2

- April 29, 2019

- | Louis Teo

In the second part of our blog series sharing wisdom from a great trader,Jesse Livermore, we round up five more quotes from the legendary trader that continue to guide many in their trading journey...

Breaking News: Yen Climbed Despite a Dovish BoJ

- April 25, 2019

- | Fullerton Markets

As yen’s movement is decided by risk sentiment instead of BoJ, short USD/JPY?

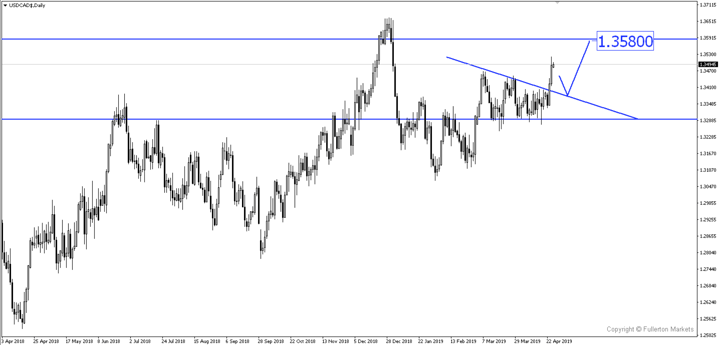

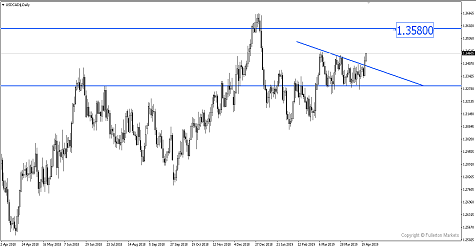

Breaking News: USD/CAD Rose to 4-Month High as BoC Turns Dovish

- April 25, 2019

- | Fullerton Markets

With Bank of Canada (BoC) downgrading their economic forecast and shifting their bias to dovish, Canadian dollar could continue to fall. Long USD/CAD?

Sneak Peek: BOC Meeting Offers Opportunities To Buy USD/CAD

- April 24, 2019

- | Fullerton Markets

Crude oil may start to retreat as IEA pledges to ensure enough supply, long USD/CAD at dip?

Popular Read

Topic List

Open Account

Leverage |

: |

Up to 1:500 |

Spread |

: |

Starting as low as 0.1 pip |

Min Trade Size |

: |

0.01 Lot |

Support |

: |

24-hour (Monday - Friday) |