Breaking News: Dollar Held Steady Despite Fed’s Forecast Cut

- December 20, 2018

- | Fullerton Markets

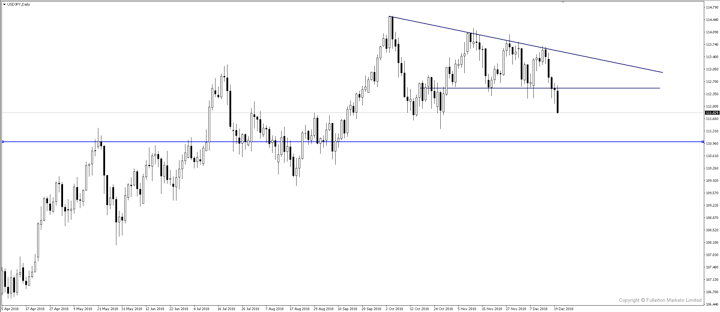

With growth and inflation forecast lowered and dot plot signalling two instead of three rate hikes, USD/JPY could fall further.

Sneak Peek: Dollar Retraces from Yearly Highs Ahead of FOMC

- December 19, 2018

- | Fullerton Markets

With Fed fund futures only pricing in one rate hike in 2019, short USD/JPY?

Risk Sentiment Remains Low After Global Data Disappoints

- December 17, 2018

- | Fullerton Markets

With both China and eurozone data much worse than expected, sell AUD/USD?

Breaking News: ECB Downgrades Forecast, Draghi Turns Dovish

- December 14, 2018

- | Fullerton Markets

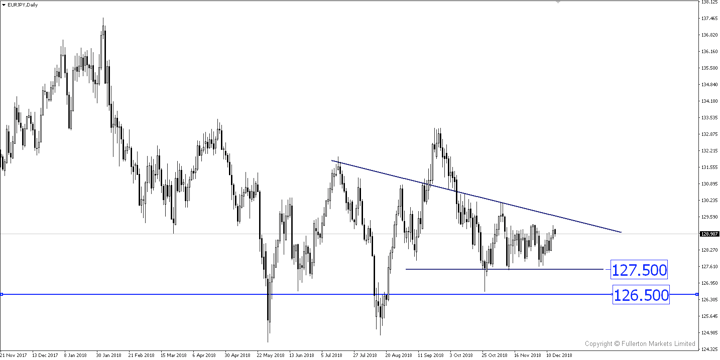

With no rate hike expected from the ECB in the first half of 2019, short EUR/JPY?

Sneak Peek: What to Expect from the ECB Tonight?

- December 13, 2018

- | Fullerton Markets

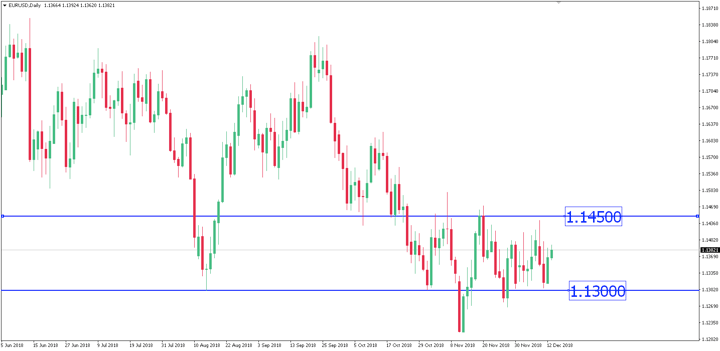

If Draghi downgrades growth forecasts and lowers the inflation target for next year, EURUSD could dive lower.

Breaking News: GBP/USD at 18-month Low After Theresa May Calls Off MP’s Vote for Brexit Deal

- December 11, 2018

- | Fullerton Markets

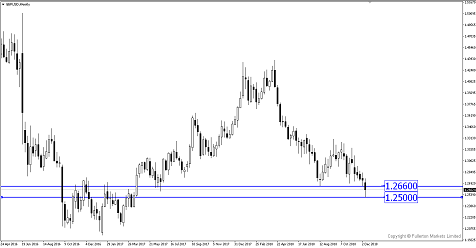

If UK Prime Minister May returns from Brussels with the same deal, we could see sterling dive lower. GBP/USD is at risk to fall further.

Huawei Arrest Case Ripping Global Market

- December 10, 2018

- | Fullerton Markets

Weaker US jobs data and trade tensions could curb sentiment in risk assets, sell USD/JPY?

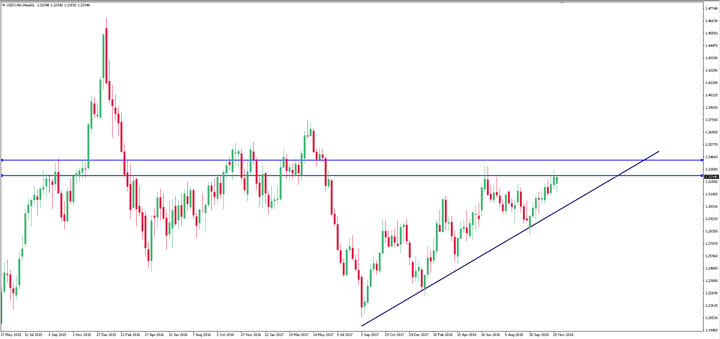

Sneak Peek: Will the Slump in Oil Prices Affect the Tone of BoC Tonight?

- December 5, 2018

- | Fullerton Markets

If Bank of Canada were to disregard the fall in oil prices and focus on normalising the monetary policy, we could see USD/CAD fall.

Slow Global Economy Means Sell Aussie

- December 3, 2018

- | Fullerton Markets

China’s growth challenges remain even with a trade war truce, look to sell AUD/USD at peak.

Popular Read

Topic List

Open Account

Leverage |

: |

Up to 1:500 |

Spread |

: |

Starting as low as 0.1 pip |

Min Trade Size |

: |

0.01 Lot |

Support |

: |

24-hour (Monday - Friday) |