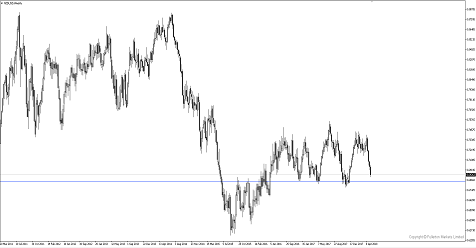

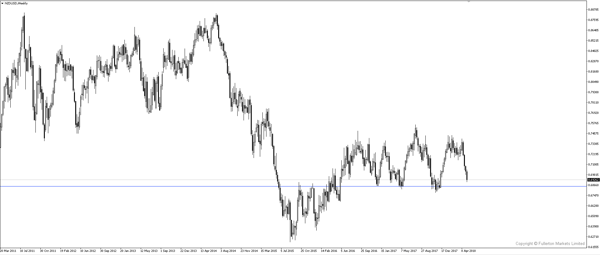

Kiwi fell to its lowest in 2018 after Governor Orr statement, Short NZD/USD?

RBNZ have left rates unchanged at 1.75% as expected. Even though New Zealand has seen solid global and domestic growth, with the economy operating around full potential, RBNZ have revised forecast for GDP and Inflation downwards.

Three dovish statements have led us to believe that NZD will continue to fall in weeks to come:

- Governor Adrian Orr mentioned they are in no rush to increase interest rates as he sees “consumer price inflation gradually rises to our 2% annual”. He further noted “Only time and events will tell” which is yet another dovish signal from the bank

- RBNZ’s cash rate profile shows that a 25bp rate hike not fully factored until Q1 2020.

- RBNZ downgraded its forecast for GDP growth and inflation in the period forward.

Despite New Zealand’s headline CPI inflation on the whole has been positive, RBNZ is still pretty cautious in their policy and awaits stronger data before changing their monetary policy moving forward.

Fullerton Markets Research Team

Your Committed Trading Partner