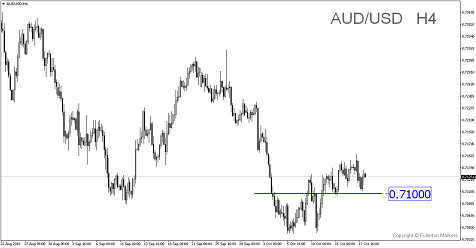

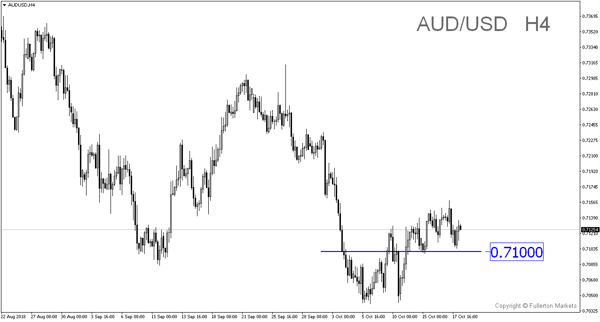

GDP data releasing at 10am (Beijing time) on Friday tomorrow is likely to show that downward pressure could intensify, short AUD/USD?

China’s 3Q GDP will be the focus tomorrow, with growth under pressure from an escalating trade war with the US.

- China’s growth may slow to 6.6% year on year in 3Q, down from 6.7% in 2Q. On the external front, US tariffs started to bite into China’s exports and production.

- Domestic demands will show that effects of supportive monetary and fiscal measures have yet to impact the real economy.

- Earlier indicators showed China’s activity data for September revealed a mixed picture, with industrial output growth weakening, retail sales flat and fixed-asset investment edging up.

- Fed minutes showed that majority of Federal Open Market Committee (FOMC) members favoured an eventual and temporary move in the policy rate above the level they deemed neutral for the economy. This should be good for the US dollar.

- Market will continue to watch the development in the US-China trade tension, which would have a knock-on impact on Australia.

Fullerton Markets Research Team

Your Committed Trading Partner