Draghi may signal to cut its monthly stimulus size to EUR 30 billion, long EUR/USD?

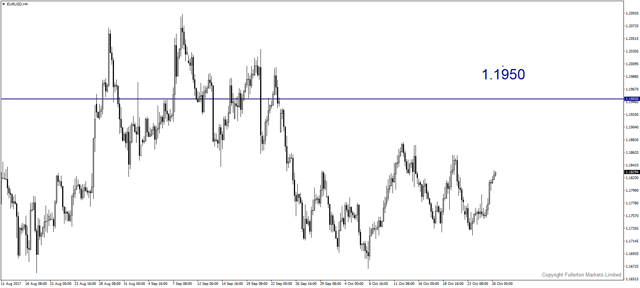

Any clues on how ECB is going to reduce their bond buying programme at the policy meeting tonight may send EUR/USD towards 1.1950.

- Bloomberg surveyed 57 economists last week, results showed ECB will cut monthly purchases to EUR 30 billion starting in January 2018.

- There are three possible scenarios tonight:

- First scenario: If the prediction by economists is accurate, we think EUR/USD may climb towards 1.1950.

- Second scenario: If ECB do not mention the details of QE unwinding, EUR/USD may move towards 1.1750 immediately.

- Third scenario: If ECB shows they are going to cut monthly stimulus size to the amount below EUR 30 billion, EUR/USD may jump above 1.20 in coming days.

- Among all the above scenarios, we think the first scenario has the highest possibility.

- Most of the analysts expected the current purchase programme to be extended to next September.

- ECB’s policy rate decision will be due at 7.45pm, and its press conference at 8.30pm (GMT+8 time).

Fullerton Markets Research Team

Your Committed Trading Partner