If US jobs growth momentum were to return, long USD/JPY?

US initial jobless claims fell sharply last month, hinting that the US economy isn’t as pessimistic as what some markets expect.

- We don’t expect the poor jobs data in February to extend into March. Such an outcome would mean that the economy is still in the process of recovery.

- We expect an NFP gain of 160k in March. March payrolls have historically shown to disappoint relative to consensus. However, the tendency for payrolls to overshoot expectations in February was expected.

- The recent US economic indicators were much stronger than those in the eurozone, confirming our point of view that the dollar could hold as its economy is still relatively stronger.

- The unemployment rate is expected to hold steady after a two-tenth decline in February. We project above-trend employment growth to continue into 2019, further nudging down the unemployment rate to 3.5% by year end.

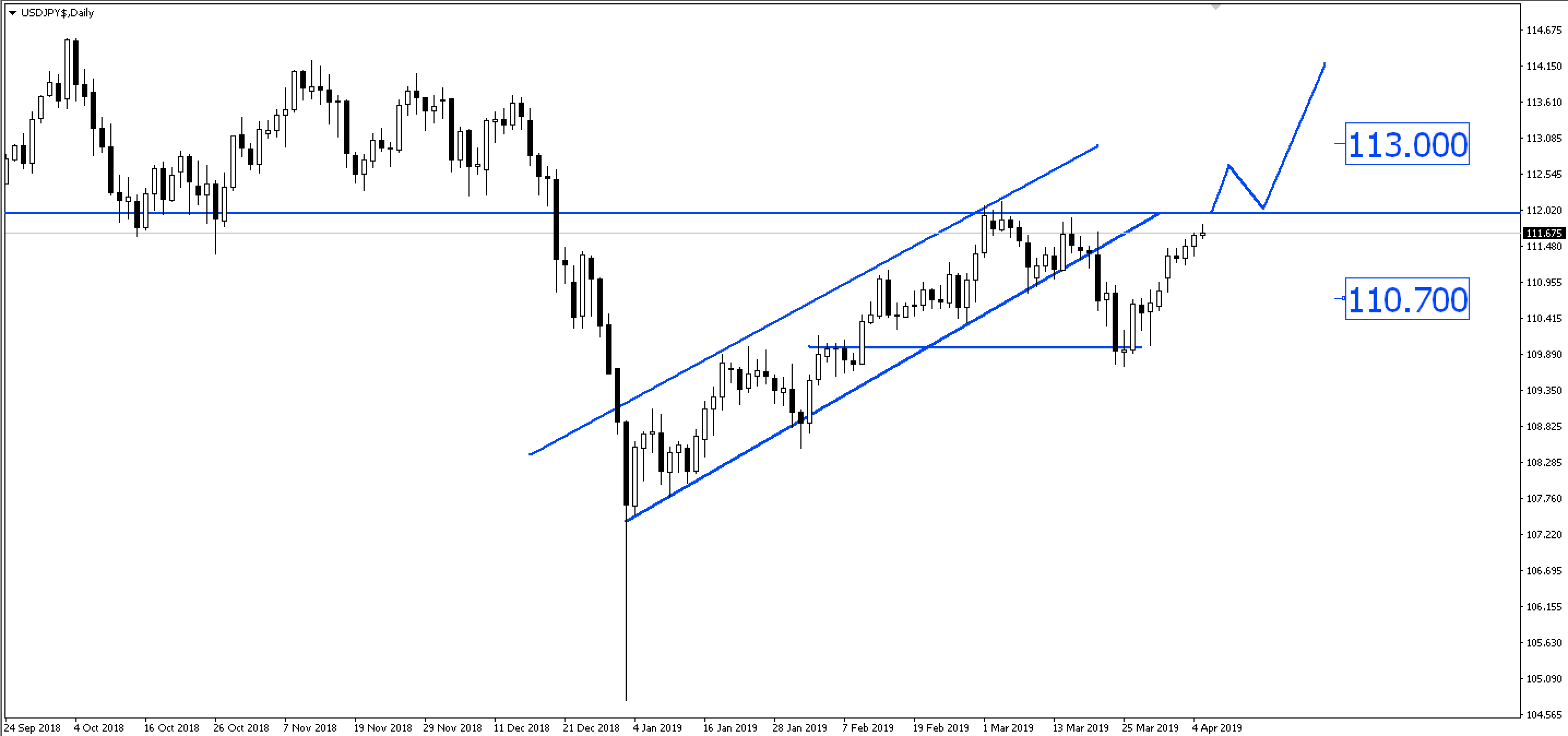

- USD/JPY is approaching a psychological resistance at the 112.00 price region. If jobs growth were to resume the 150-175k numbers, this could send USD/JPY above the 112.00 resistance. If data came out softer, USD/JPY could fall towards the 110.70 support.

Fullerton Markets Research Team

Your Committed Trading Partner