If Bank of Canada were to disregard the fall in oil prices and focus on normalising the monetary policy, we could see USD/CAD fall.

The Bank of Canada is widely expected to keep its benchmark overnight interest rate on hold tonight.

During BoC’s last meeting, it raised its benchmark interest rate by a quarter point to 1.75%. It was the fifth hike since last summer, further pushing up the cost of borrowing for Canadians. In the statement it released at that time, the central bank removed the word "gradual" in reference to the pace of further rate hikes. Some analysts read the omission to mean that the bank may raise its overnight lending rate more quickly to get to a more neutral level of between 2.5 and 3.5%.

However, since then oil prices of both West Texas Intermediate and Western Canadian Select have fallen significantly. The differential between WTI and WCS widened so much that Alberta's Premier, Rachel Notley, called it a "crisis" and announced a temporary oil production cut to reduce the bottleneck of oil struggling to get to market. The cost of crude oil has dropped more than 25% and the price of Western Canada Select (the primary blend sold by Alberta’s oil sands) fell another 12%.

The temporary oil production cut managed to rally Canadian crude, and its discount to WTI has narrowed to $24 a barrel as of Tuesday evening which was less than half what it was a month ago.

Canada, being a major exporter of oil, is very dependent on oil prices which could factor into their GDP.

Despite the weakening oil prices, economic data is not terrible. Retail sales are up, the unemployment rate is down, inflation is well above 2% and the manufacturing sector is growing strongly. The Canadian economy continues to reap the rewards of strong US activity and should see a respectable 2.5% growth rate overall for 2018. Though, a slightly slower pace of growth in 2019 could happen, reflecting a more moderate expansion in the US.

Furthermore, the revised free trade agreement was signed by Canada, US and Mexico during the G20 Summit last week, which should remove the grey clouds from the investment outlook of Canada. In addition, the US-China 90-day trade truce could also bolster confidence in Canada’s economy at least until March of 2019.

The near-term target inflation should keep BoC to continue tightening into 2019. Inflation is expected to ease towards BoC’s target of 2% next year, from 2.3% in 2018 to 2.1% in 2019.

All eyes will be on BoC Governor Stephen Poloz’s speech tonight for signs of how events are affecting his view of the path forward.

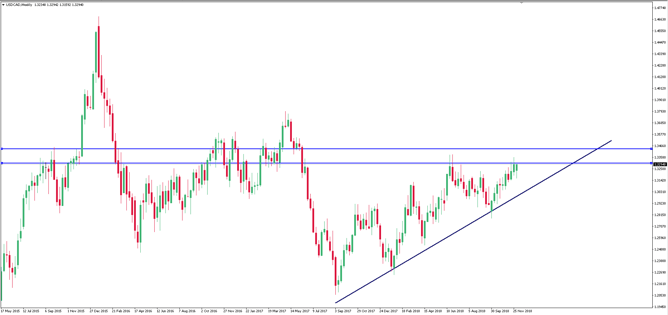

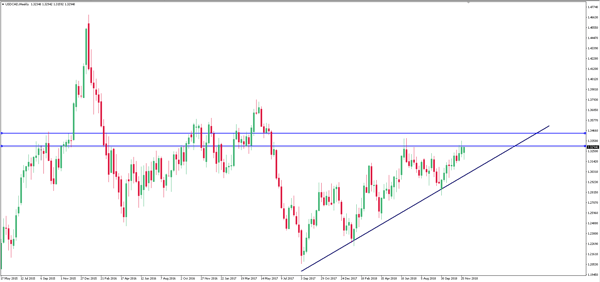

If he disregards the slump in oil prices and continues to hold his stance in normalising the monetary policy, we could see USD/CAD fall towards the 1.3000 support.

If Poloz mentions that the fall in oil prices is a major concern and they would move very gradually in increasing its overnight rate, then we could see USD/CAD breaking the 1.330 resistance towards 1.340.

Fullerton Markets Research Team

Your Committed Trading Partner