Despite recent stabilisation in eurozone data which could prompt slight optimism from the ECB, the eurozone still faces many concerns. Short EUR/USD after initial rally.

EUR/USD has been heading higher ahead of the ECB meeting tonight as short-sellers start to take profit while others are expecting a hint of optimism from the ECB based on improvement in German data. The recent improvement in German data, although insignificant compared to the overall eurozone weakness, could be an excuse for the ECB to sound less dovish during the meeting tonight.

There are four reasons why we feel euro dollar will remain weak in the longer term:

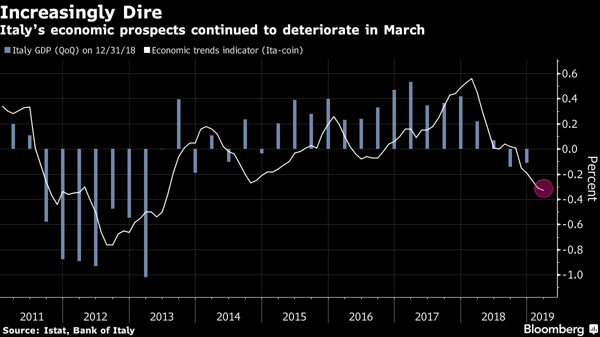

Italy’s economy fell into recession during the end of 2018 and seemed to have extended into the first quarter of 2019. A Bank of Italy indicator for economic activity fell in March to the weakest level since July 2013. Furthermore, OECD (Organisation for Economic Co-operation and Development) and the European Commission have downgraded Italy’s growth forecast to 0.2%, marking its first full-year contraction since 2013.

2) US-EU trade tensions

The US is threatening the EU with fresh tariffs (that include food and wine) on top of the auto tariffs. This tariffs package is estimated at $11B. The latest threat by the White House to slap higher import tariffs on a major trading partner comes after a long-running dispute between the US and the EU over their state subsidy support for Airbus and Boeing, the world’s two biggest civil aerospace firms.

EU officials have also started to prepare retaliatory measures in relation to subsidies given to Boeing by the US government. These tit-for-tat measures will harm euro in the process.

3) Tepid inflation growth

The euro area inflation slowed from 1.5% in Fed to 1.4% in March this year while the core gauge reached a 11-month low at 0.8% versus the previous at 1.0%. With headline inflation further away from the target of 2.0%, this would continue to weigh on euro dollar.

4) Slowdown in global growth

The International Monetary Fund (IMF) cut its global economic growth forecasts for 2019 from 3.5% to 3.3%, the slowest expansion since 2016. They pointed to the US-China trade war and Brexit as key risks and warned that chances of further cuts to the outlook are high.

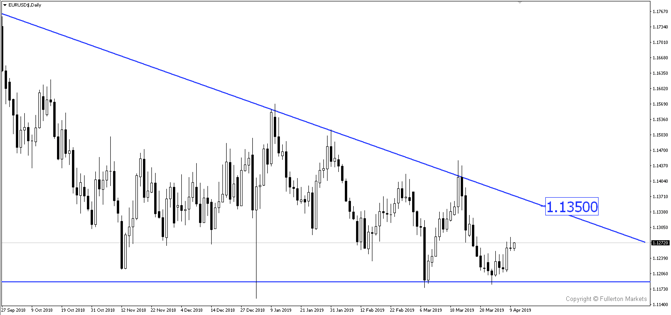

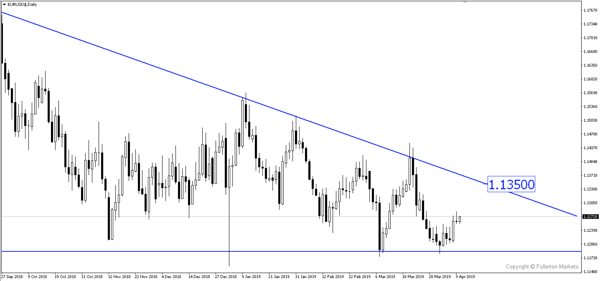

All in all, ECB will try its best to remain neutral as there is some sign of improvement in data. At the last meeting, Draghi expressed his concern on these aforementioned issues that sent euro diving lower. We feel that any rally in EUR/USD will invite short-sellers to enter.

We believe that EUR/USD will rally to 1.1350 if Draghi shows any hint of optimism. The gains, however, will be capped and this will present a good opportunity for a short.

Fullerton Markets Research Team

Your Committed Trading Partner