Investors have been seeking confirmation that debt-ceiling negotiations are progressing positively following President Biden's optimistic remarks to avoid a default. The sentiment was boosted as House Minority Leader McCarthy's comments indicated that Congress might raise the debt ceiling. Treasury yields experienced an increase after weekly initial jobless claims came in below expectations, with continuing claims reaching their lowest level since early March.

As the debt ceiling negotiation progresses, there are indications that the Federal Reserve may need to revise its unemployment estimates to bring them lower and increase growth forecasts. This adjustment could potentially lead to a higher fed funds target for 2023, which could significantly impact the stock markets.

Presently, investors are anticipating a pause followed by three rate cuts by January 2024, with no discussions surrounding a pause and subsequent rate hikes. Recent remarks by Dallas Federal Reserve President Lorie Logan, suggesting the possibility of another 25 bps of tightening, seem at odds with the Nasdaq 100 reaching a one-year high, highlighting conflicting sentiments between hawkish Fed rhetoric and the tech sector's performance.

Tech Sector Buoyed by Hopes of More Aggressive Future Rate Cuts

Fed fund futures currently reflect pricing for 3-4 cuts in the next six to twelve months, indicating a rapid turnaround from the potential benchmark rate of 5.5%. The tech sector, often viewed as a safe haven, appears to be buoyed by the expectation that more immediate tightening measures will result in more substantial future rate cuts.

Walmart Exceeds Expectations, Boosts Full-Year Forecast

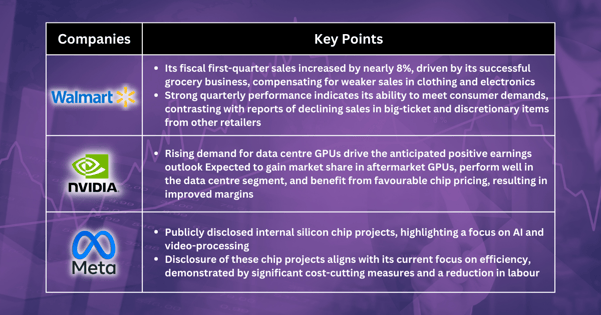

Walmart announced a nearly 8% rise in fiscal first-quarter sales, propelled by its thriving grocery business, offsetting weaker sales in clothing and electronics. The retail giant raised its full-year forecast following the earnings beat, projecting a consolidated net sales increase of approximately 3.5% for the fiscal year. The company anticipates adjusted earnings per share between $6.10 and $6.20 for the full year, aligning closely with analysts' expectations.

Walmart's quarterly results offer valuable insights into the overall health of the American consumer. Despite reports from Home Depot and Target indicating a decline in sales of big-ticket and discretionary items due to increased expenses on necessities earlier in the week, Walmart's robust performance highlights its resilience in meeting consumer demands.

Nvidia's Earnings Outlook Points to Further Stock Price Strengthening

Nvidia, the leading chipmaker at the forefront of the AI revolution, is expected to present a positive earnings outlook. The ongoing rush towards artificial intelligence and subsequent demand for data centre graphics processing units (GPUs) should drive improved results and guidance for the company. Nvidia's stock has already more than doubled this year, largely fueled by robust AI demand that has propelled the market. Furthermore, aftermarket GPU share gains, solid data centre strength and favourable chip pricing are anticipated to positively impact Nvidia's margins.

Meta's Custom Chips: Unveiling AI Advancements

Meta, the social networking giant, publicly disclosed its internal silicon chip projects for the first time, signalling its focus on artificial intelligence and video-processing tasks. The company recently discussed these projects with reporters, shedding light on its AI technical infrastructure investments during a virtual event. These developments come at a time when Meta is prioritising efficiency, marked by significant cost-cutting measures and a considerable reduction in its labour.

Fullerton Markets Research Team

Your Committed Trading Partner