The 10-year Treasury yield has demonstrated its resilience following positive employment data, highlighting the ongoing robustness of the labour market. Still, the stock market looks stabilised for now.

The upbeat labour market, complemented by robust consumer spending highlighted in Wednesday's retail sales report for December, has prompted optimism among investors. There is a growing belief that the Federal Reserve may be less inclined to carry out as many interest rate reductions as previously expected. Currently, CME FedWatch suggests a 56% chance of a March quarter-point rate cut.

This positive economic outlook, driven by a tightening labour market and strong consumer activity, positions the market for stability and growth. Investors are recalibrating their expectations based on the encouraging data, fostering confidence in the economy’s resilience and the potential for a more measured approach to monetary policy adjustments by the Fed.

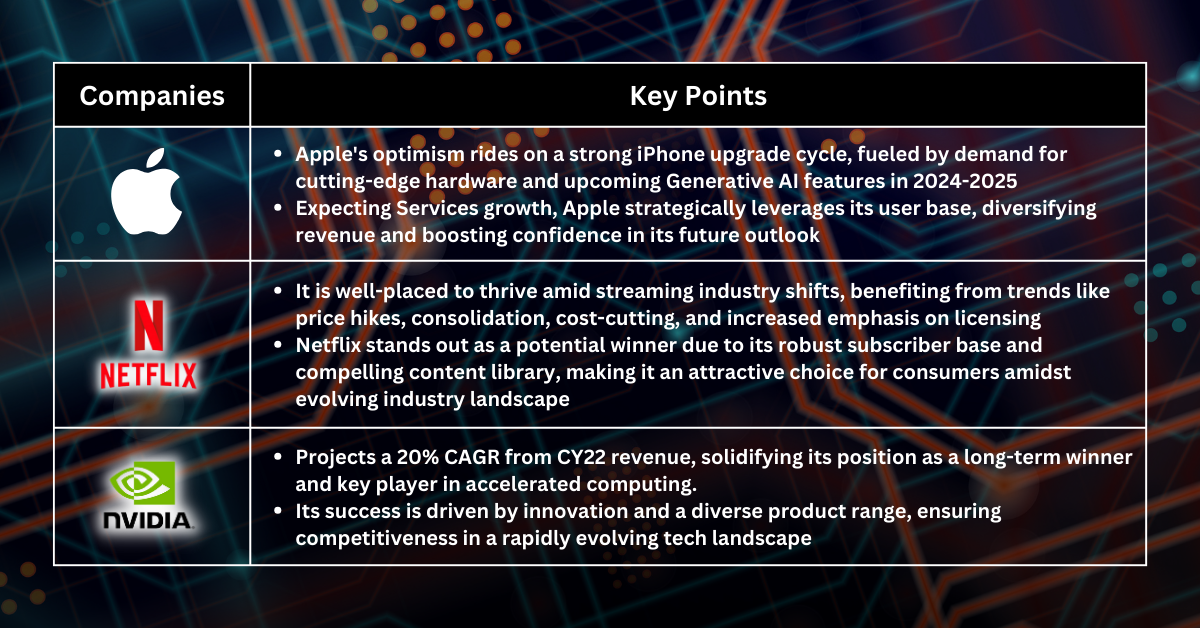

Apple: Robust multi-year iPhone upgrade cycle

The primary catalyst identified is the robust multi-year iPhone upgrade cycle, propelled by an increasing demand for cutting-edge hardware. This surge is driven by the upcoming inclusion of Generative AI features in 2024 and 2025, making the latest iPhone models essential for users. Furthermore, we foresee an uptick in growth for Apple's Services segment as the company enhances its ability to monetise its expansive installed base. This shift in perspective reflects a broader recognition of Apple's evolving revenue streams beyond hardware sales.

The confluence of these factors has led to a bullish stance on Apple's prospects, reflecting confidence in the company's ability to capitalise on its existing user base and the forthcoming technological advancements in the pipeline.

Netflix: Advantageous position

Netflix is in an advantageous position to strengthen as the industry undergoes a series of strategic shifts. With the broader trend of price hikes within the streaming landscape, consolidation of platforms, cost-cutting measures, and a renewed emphasis on licensing, we identify Netflix as the primary beneficiary poised for substantial gains.

As competitors within the streaming sector adjust their pricing models, Netflix stands out as a potential winner. The company has built a robust subscriber base, and its ability to provide a compelling content library continues to resonate with consumers. As industry players navigate the evolving landscape, the anticipated price increases by others may drive more subscribers toward Netflix, seeking a combination of quality content and reasonable pricing.

Additionally, the streaming platform consolidation suits Netflix's market position. The company's established global footprint and diverse content offerings position it well to attract users migrating from platforms changing. This shift in market dynamics opens up opportunities for Netflix to expand its subscriber base further.

NVIDIA: 20% CAGR off CY22 revenue

NVIDIA emerges as a compelling long-term winner in accelerated computing, poised for sustained growth with a projected Compound Annual Growth Rate (CAGR) of 20% based on its Calendar Year 2022 revenue. The company's strategic positioning within the accelerated computing landscape places it at the forefront of transformative technological trends, positioning it as a key player in shaping the future of computing.

The fast-changing accelerated computing market centred on GPUs, AI, and data centre solutions is evolving quickly. NVIDIA, a pioneer in this field, benefits from various factors driving its growth. The increasing demand for high-performance computing, particularly in AI applications, positions NVIDIA as an essential enabler of technological advancements across different industries.

The 20% CAGR projection from CY22 revenue underscores the confidence in NVIDIA's ability to capitalise on expanding market opportunities. The company's diverse product portfolio, spanning gaming GPUs, professional visualisation solutions, data centre GPUs, and automotive platforms, positions it as a versatile player with a broad market reach.

Key to NVIDIA's sustained success is its commitment to innovation and research in cutting-edge technologies. The company's ongoing developments in GPU architecture, AI-driven solutions, and advancements in data processing contribute to its competitive edge and resilience in a rapidly evolving tech landscape.

Fullerton Markets Research Team

Your Committed Trading Partner