Despite the Federal Reserve's intention to convey a message of anticipated interest rate increases, the market responded with scepticism. Following the FOMC meeting in June, stocks turned bullish as investors processed the post-meeting information. Two main conclusions emerged: there may be a maximum of one rate hike on the horizon, and the market expects favourable monetary policy from here. Doubts persist regarding the Fed's determination to restore price stability should the economy experience a significant slowdown. The Fed faces the decision of either pursuing its current path or abandoning it, and the market currently doubts the likelihood of a second-rate hike or a sustained higher rate stance.

Microsoft Achieves Record Highs Amidst AI Growth Prospects

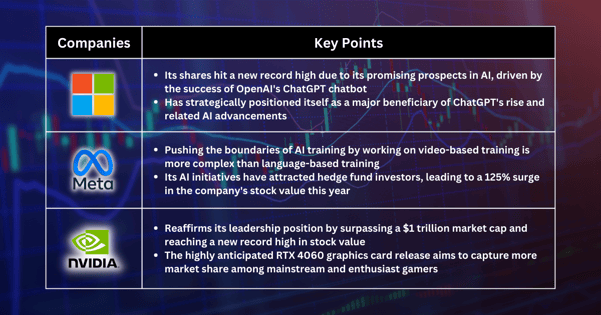

Microsoft's shares reached a new record on Thursday, propelled by the company's promising prospects in artificial intelligence. The stock closed at $348.10, surpassing its earlier all-time high from November 2021, coinciding with the Nasdaq's peak that month.

The prominence of AI has been a prevailing theme throughout the year, particularly with the popularity of Microsoft-backed OpenAI's ChatGPT chatbot, which rapidly gained attention. Tech companies have swiftly integrated AI into various products and features, highlighting the potential for cost savings amid concerns about a looming recession.

Microsoft stands as a significant beneficiary of ChatGPT's rise and related developments. Not only has the company made substantial investments in OpenAI, but it also provides the underlying computing power. Furthermore, Microsoft holds an exclusive license for OpenAI's models, including the GPT-4 large language model that generates human-like text responses.

Meta Ventures into AI Video Training, Posing a Game-Changing Opportunity

Meta's Chief of AI revealed that the company is actively working on training AI using video data, a more challenging task compared to language-based training. This development holds immense significance. Meta has gained popularity among hedge fund investors for its technological advancements and AI initiatives. Recently, the company unveiled AI computer chips designed to enhance metaverse-related activities such as virtual and augmented reality and generative AI. With a 125% surge in its stock value this year, Meta captures the optimism surrounding AI.

Nvidia Regains Trillion-Dollar Market Cap Status

Nvidia, known for its leadership in the semiconductor industry and artificial intelligence capabilities, has once again surpassed a market cap of $1 trillion, reaffirming its position as a frontrunner. The company's stock reached another record high this week. Our positive outlook stems from Nvidia's latest graphics card and their forthcoming game release. As new cards gain traction, Nvidia continues to expand its market share, with graphics card user share climbing to 76.4%.

Awaiting accelerated adoption trends, we look forward to the launch of the RTX 4060, the latest addition to Nvidia's popular '60 series' primarily targeting mainstream and enthusiast gamers.

Fullerton Markets Research Team

Your Committed Trading Partner