Despite upbeat economic data, stocks faced resistance due to disappointing corporate performance and persistent banking fears. In April, wholesale prices in the US rose 0.2% for the month, translating to a 2.3% year-over-year increase, which is down from March's 2.7% and the lowest since January 2021. While initial jobless claims increased by 22,000 to 264,000 for the week ended May 6, which is the highest reading since Oct. 30, 2021, indicating that inflation may be coming under control.

However, investor focus is on the economic backdrop and liquidity, including rates and inflation. The health of banks and their willingness or ability to make loans were in focus again, with PacWest shares, Zions Bancorp, and KeyCorp falling, and the SPDR S&P Regional Banking ETF sliding 2.5% on Thursday. Meanwhile, the Nasdaq Composite managed to gain recently, boosted by a jump in big tech names like Alphabet, which is trading at its highest level since August, thanks to investors' optimism around the artificial intelligence products announced at its annual developers' conference.

Investor focus will turn to the looming debt ceiling in the US after a heavy week of economic data releases. Yields for short-term T-bills have jumped sharply this month, and unease over a potential sovereign default has already spread through markets. Although most economists and bankers, including JPMorgan CEO Dimon, expect the US to avoid defaulting, it's hard to imagine what would happen if they were proved wrong.

Tesla's Share Boost from Twitter's Moves

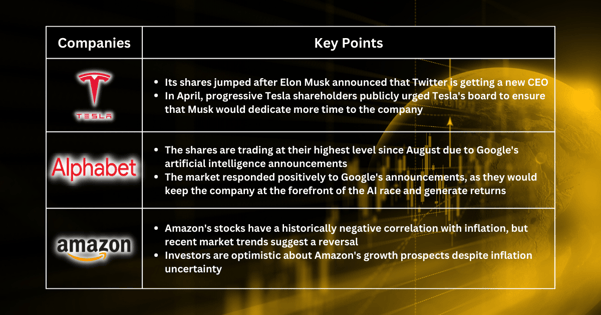

Tesla shares jumped after Elon Musk announced that Twitter is getting a new CEO, and he will move to a product and technical role. Several Tesla investors were concerned that Musk was too distracted by running Twitter and that he should redirect his time to steering the electric vehicle company, where he is also CEO. In April, a host of progressive Tesla shareholders publicly urged Tesla's board to ensure that Musk would dedicate more time to the automobile company.

Alphabet Catching Up in AI Racing

Shares of Alphabet are trading at their highest level since August, thanks to Google's artificial intelligence announcements at its developer conference. Google announced that it would bring AI features to its signature search product, allowing it to turn complex queries into simple answers by synthesizing results. Additionally, Google said that its suite of workplace tools, like Google Docs, would soon let users create new documents and fill out spreadsheets with AI. The company also revealed that it would make its Bard AI chatbot more widely available and that it would soon have the ability to respond in different languages and images.

The market appeared pleased with Google's announcements, as it would keep the company at the forefront of the AI race and generate returns.

Amazon: Winner When Inflation Slows Down

Amazon's stock has a negative correlation with inflation, implying that as inflation rises, the performance of Amazon's stock tends to be negatively affected. However, recent market trends show that this negative correlation is reversing as inflation shows signs of moderating. Amazon has been leading the market rally in the current year, with its stock prices surging by almost 27%. This suggests that investors are becoming more optimistic about Amazon's growth prospects despite the uncertainty surrounding inflation. Furthermore, it highlights the resilience of the company's business model and its ability to adapt to changing economic conditions. Overall, Amazon's strong performance in the face of inflationary pressures is a testament to its position as one of the most influential players in the e-commerce industry.

Fullerton Markets Research Team

Your Committed Trading Partner