The recent crisis in the banking sector, from SVB to Credit Suisse, has raised concerns and highlighted the need for central banks to be cautious about hiking rates. If the Fed takes a more cautious stance, bond yields may drop further, which could be good news for big tech stocks.

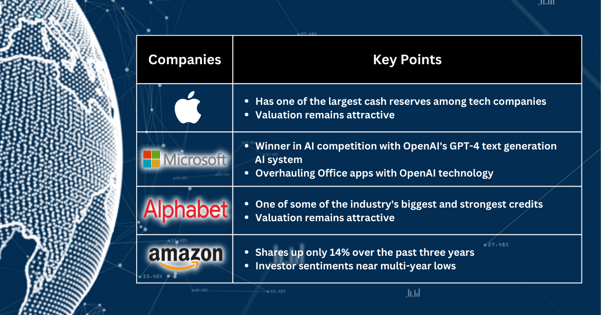

Despite a decline in tech shares from their peaks, they remain extremely resilient, with most issuers having ample cash to fund themselves without requiring significant additional capital. The 12 biggest tech companies have a total cash reserve of almost $700 billion, led by Apple and Alphabet.

Microsoft – A absolute winner in AI competition so far

Microsoft could benefit after ChatGPT maker OpenAI said it has introduced its new GPT-4 text generation AI system.

Its effort to overhaul its entire lineup with OpenAI technology has spread to one of the company’s oldest and best-known products: its Office apps.

The software, including Excel, PowerPoint, Outlook and Word, will begin using OpenAI’s new GPT-4 artificial intelligence platform, Microsoft said on Thursday. AI-powered assistants called Copilots will be able to generate whole documents, emails and slide decks from knowledge the software has gained scanning corporate files and listening to conference calls. The technology will debut in the coming months, and Microsoft is already testing it with some companies.

Apple, Alphabet’s valuation attractive

The vast majority of technology stocks’ valuation remains attractive, even after bouncing sharply off their lows, with Apple, Microsoft and Alphabet among some of the industry's biggest and strongest credits on that list.

As fundamentals get worse before they get better and begin to trough in 2023, the safer-haven traits of technology debt, including cash-rich balance sheets and limited ratings risk, may lead to improved excess returns vs. broader index peers for the remainder of the year, even as recessionary fears persist.

Amazon lags behind its peers, time to catch up?

Amazon shares are up only 14% over the past 3 years vs. the SPX up 63%, and we continue to believe investor sentiment on Amazon is near multi-year lows.

Fullerton Markets Research Team

Your Committed Trading Partner