Tech stocks are in for a brutal reversal lower if yields decline further, and that may happen as the Fed officials seem to have no chance to act hawkish in the coming weeks, at least given the current banking crisis.

Treasury Secretary Yellen spooked the market on Wednesday but now seems to come back with a more supportive tone. The S&P 500 rebounded from a deficit, though it’s struggling to stay in positive territory. Maybe she’s taking a lesson from the Fed playbook: Get tough on the first day of testimony and soften the message on the second day.

It has been a very rough month for riskier assets, but technology stocks seem to be doing just fine. The Nasdaq 100’s 5.7% gain in March stands out against the S&P 500’s 0.5% retreat and the considerably deeper declines across many major markets.

The longtime playbook of lower yields means higher tech stocks still look to be the ones many investors are committed to. After all, for most of this century, yields kept moving lower, and the Nasdaq kept moving higher.

Tech is sitting on top of the S&P 500 today and is one of the best performers this month, while the runaway winner, the Nasdaq 100, is powering into a bull zone. Big tech stocks offer steady revenue and market dominance that can relatively hold up in a downturn. At the same time, they have strong balance sheets that could offer some safety amid any bank turmoil.

Tech’s miserable 2022 and the recent easing in bond yields have made the sector more attractive. But questions remain over whether the sector captures enough risk.

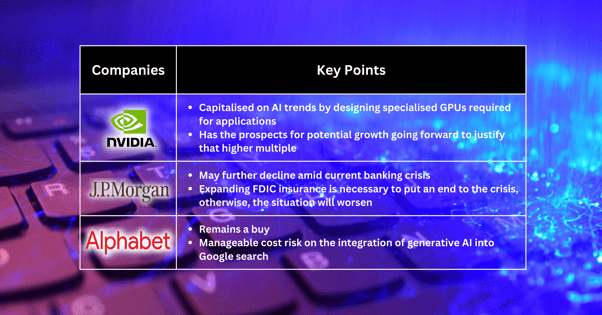

Nvidia’s boom is yet to be over.

Nvidia’s business model centres around selling high-performance graphics processing units essential for running the algorithms behind artificial intelligence technologies.

AI has become increasingly important across industries, and demand for GPUs has surged. Nvidia has capitalised on this trend by designing specialised GPUs that can handle the complex calculations required for applications such as deep learning and natural language processing.

It is one of the companies where we feel more comfortable with the prospects for that potential growth to justify that higher multiple. Investors are looking for ways to invest in the artificial intelligence theme, and Nvidia has shown its ability to capture a lot of that zeitgeist.

JP Morgan may further decline amid the current banking crisis.

The market is still dealing with the potential fallout of the banking crisis. Some banking stocks may fall further.

Investors have been abuzz lately about the possibility that the Federal Deposit Insurance Corporation would consider providing “blanket insurance” for all banking deposits. In a testimony Wednesday, during Federal Reserve Chair Jerome Powell’s press conference, Treasury Secretary Janet Yellen said the FDIC was not considering it.

The next step in navigating the ongoing crisis starts there, and he believes the government will have to do that to end this crisis.

The next phase is we have to expand FDIC insurance. If they do not, this is going to get worse. But we believe that that is going to occur.

Alphabet remains a buy.

We see cost risk around the integration of generative AI into Google search results as manageable.

Fullerton Markets Research Team

Your Committed Trading Partner