In recent months, the Nasdaq 100 has been the top-performing index in the US stock market, with a surge of over 20%, leading analysts to speculate that the index is in a bull market. However, caution is advised due to inflation being a primary challenge for the market, resulting in higher interest rates and reduced consumer spending. This could make it less affordable for consumers to borrow money and for companies to make capital expenditures, leading to lower profit margins. Despite the excitement for the Nasdaq 100's performance, it's important to keep in mind that the stock market can be volatile.

Meta Platforms

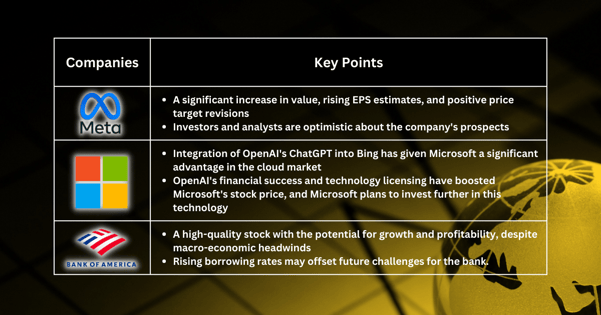

Meta Platforms, the parent company of Facebook, has seen a significant increase in value, rising EPS estimates, and positive price target revisions. Investors and analysts alike are optimistic about the company's prospects as technology stocks make a comeback and the company focuses on efficiency, even with the recent announcement of layoffs.

Microsoft

Microsoft has gained a significant advantage over its competitors in the cloud market with the integration of OpenAI's ChatGPT into Bing, allowing for more relevant and accurate search results. OpenAI's strong financial performance and licensing of technology to other companies have also contributed to Microsoft's stock price increase. Microsoft is expected to continue investing in this technology to leverage its capabilities in the future.

Bank of America

Bank of America is considered a high-quality stock with potential for growth and profitability, despite macro-economic headwinds that could hinder recent revenue growth. The continued climb in borrowing rates is seen as a positive factor that could help to offset any challenges the bank may face in the future.

Fullerton Markets Research Team

Your Committed Trading Partner