The stock market faced a dip recently, spurred by a mixed bag of corporate earnings and concerning economic data, including signs of a contracting economy. Disappointing results from companies like Tesla and weakness in key technology companies like Nvidia, Microsoft, Meta Platforms, and Apple also contributed to the downward trend.

Energy markets were also weak, with oil prices dropping more than 2%. The mounting concern over downward pressure on profit margins affected Tesla shares and other technology stocks also suffered. Next week will be the real test as earnings season ramps up with a slate of results from big technology companies. The potential for a much bigger slowdown than anticipated in the economy has added to the concern.

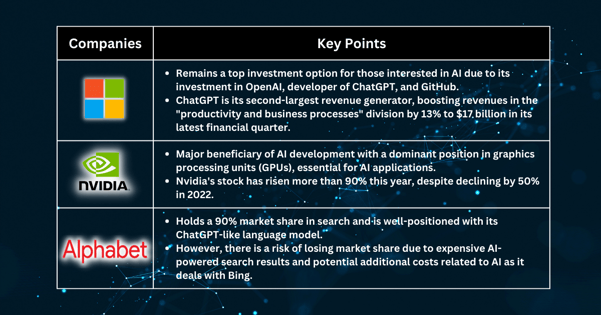

Microsoft: Remains to be top play in the AI field.

Amidst the economic turmoil, Microsoft, with a well-positioned strategy, remains a top investment option for those interested in artificial intelligence. The company has invested in OpenAI, the developer of ChatGPT, and GitHub, a code-sharing platform for software developers. Microsoft has already announced plans to integrate ChatGPT into its Office 365 productivity software suite, boosting revenues in the "productivity and business processes" division by 13% to $17 billion in its latest financial quarter. This integration makes ChatGPT the second-largest revenue generator for Microsoft. Additionally, Microsoft aims to integrate ChatGPT into its search engine Bing.

Nvidia: Major beneficiary of AI development.

Nvidia is another major beneficiary of AI development, with its stock rising more than 90% this year, despite declining by 50% in 2022. Nvidia's dominant position in graphics processing units (GPUs), essential for artificial intelligence, has been particularly relevant in the post-ChatGPT era. GPUs can handle vast amounts of data and computations required for AI applications.

Alphabet: Cost is a concern.

Currently holding a 90% market share in search, Alphabet is well-positioned with its ChatGPT-like language model. However, the risk of losing market share if a competing service alters user expectations of search results or disrupts Google's advertising-centric business model remains. The potential consequences could be expensive, as AI-powered search results cost significantly more than the current search service. Alternatively, while the company may not lose market share, it may still have to incur additional costs related to AI as it deals with Bing.

Fullerton Markets Research Team

Your Committed Trading Partner